Question: A bond is sold at $923.14 (below its par value of $1,000). The bond matures in 15 years and has a 10-percent yield, expressed as

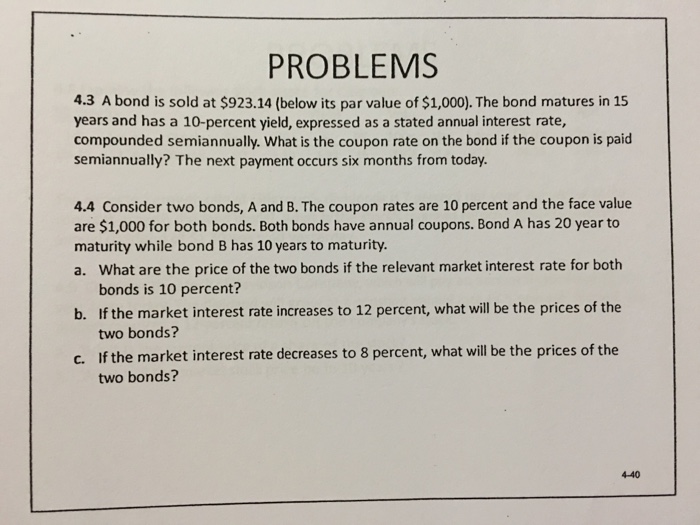

A bond is sold at $923.14 (below its par value of $1,000). The bond matures in 15 years and has a 10-percent yield, expressed as a stated annual interest rate, compounded semiannually. What is the coupon rate on the bond if the coupon is paid semiannually? The next payment occurs six months from today. 4.3 Consider two bonds, A and B. The coupon rates are 10 percent and the face value are $1,000 for both bonds. Both bonds have annual coupons. Bond A has 20 year to maturity while bond B has 10 years to maturity. What are the price of the two bonds if the relevant market interest rate for both bonds is 10 percent? If the market interest rate increases to 12 percent, what will be the prices of the two bonds? If the market interest rate decreases to 8 percent, what will be the prices of the two bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts