Question: A bond that matures two and a half years from now has a par value of $1 million, a 5% per annum coupon and

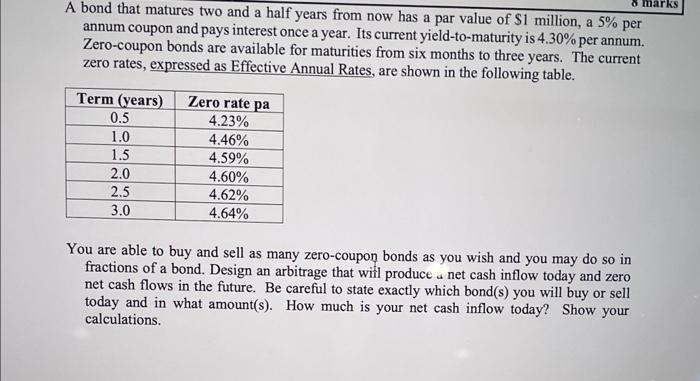

A bond that matures two and a half years from now has a par value of $1 million, a 5% per annum coupon and pays interest once a year. Its current yield-to-maturity is 4.30% per annum. Zero-coupon bonds are available for maturities from six months to three years. The current zero rates, expressed as Effective Annual Rates, are shown in the following table. Term (years) 0.5 1.0 1.5 2.0 2.5 3.0 Zero rate pa 4.23% 4.46% 4.59% 4.60% 4.62% 4.64% You are able to buy and sell as many zero-coupon bonds as you wish and you may do so in fractions of a bond. Design an arbitrage that will produce a net cash inflow today and zero net cash flows in the future. Be careful to state exactly which bond(s) you will buy or sell today and in what amount(s). How much is your net cash inflow today? Show your calculations. marks

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

To design an arbitrage we need to find a combination of zerocoupon bonds that replicate ... View full answer

Get step-by-step solutions from verified subject matter experts