Question: A bond with a $1,000 face value and a 5 percent annual coupon pays interest semiannually. The bond will mature in 15 years. The annual

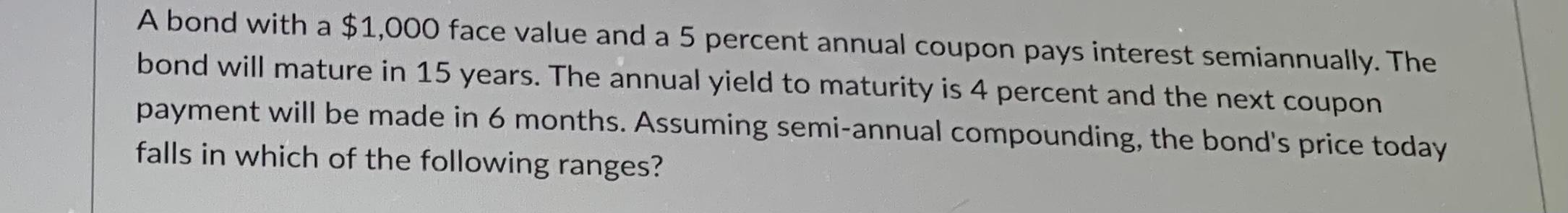

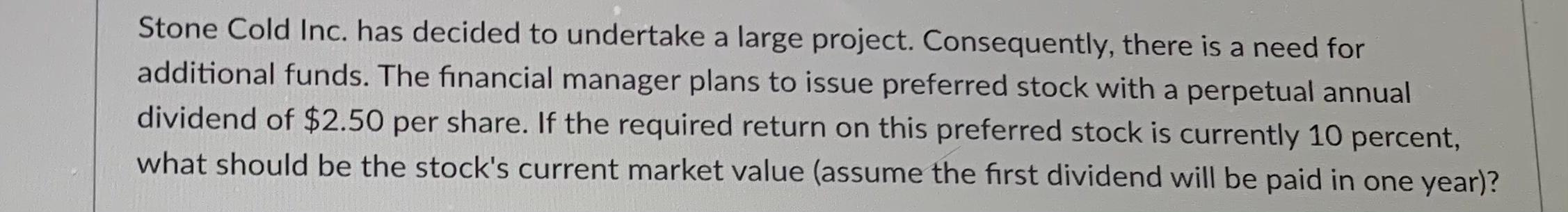

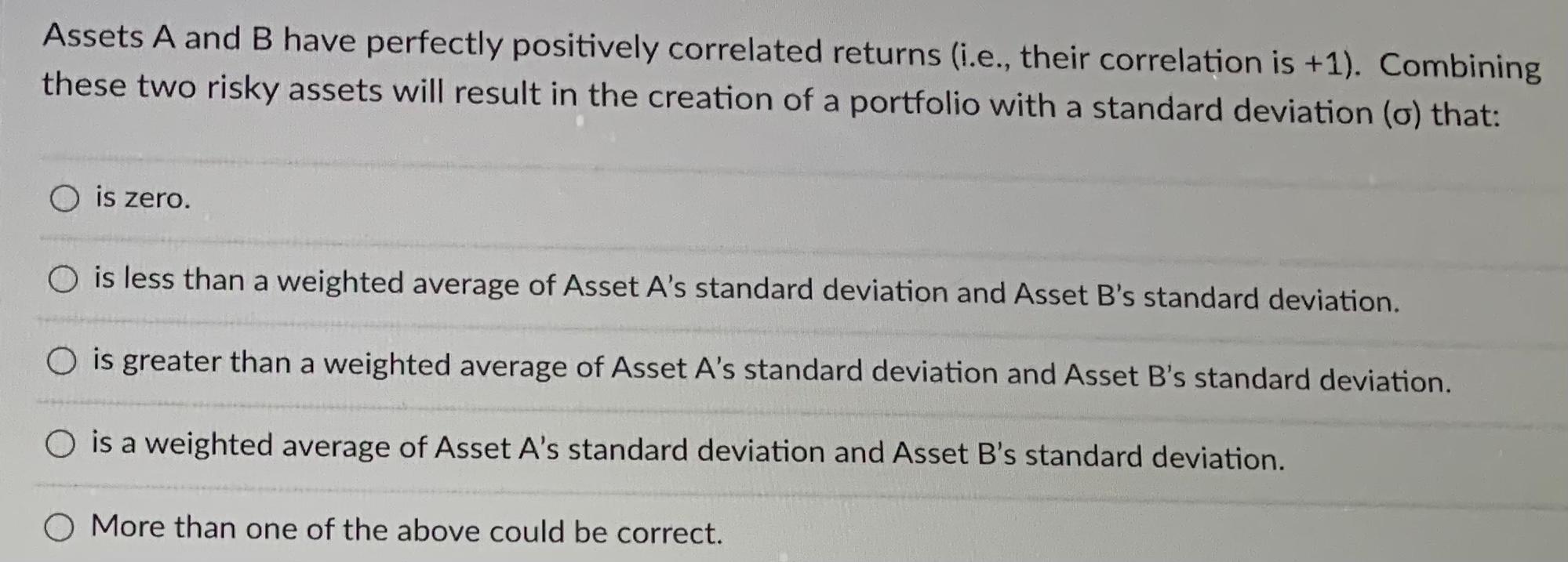

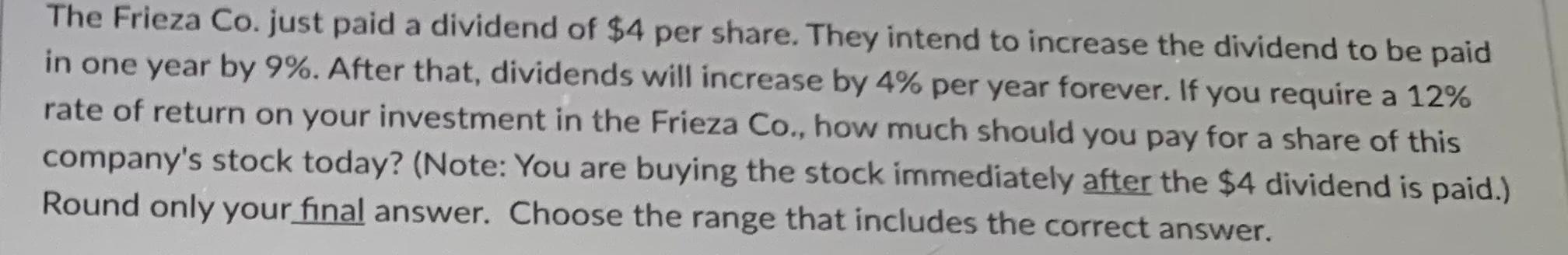

A bond with a $1,000 face value and a 5 percent annual coupon pays interest semiannually. The bond will mature in 15 years. The annual yield to maturity is 4 percent and the next coupon payment will be made in 6 months. Assuming semi-annual compounding, the bond's price today falls in which of the following ranges? Stone Cold Inc. has decided to undertake a large project. Consequently, there is a need for additional funds. The financial manager plans to issue preferred stock with a perpetual annual dividend of $2.50 per share. If the required return on this preferred stock is currently 10 percent, what should be the stock's current market value (assume the first dividend will be paid in one year)? Assets A and B have perfectly positively correlated returns (i.e., their correlation is +1). Combining these two risky assets will result in the creation of a portfolio with a standard deviation (o) that: O is zero. O is less than a weighted average of Asset A's standard deviation and Asset B's standard deviation. O is greater than a weighted average of Asset A's standard deviation and Asset B's standard deviation. O is a weighted average of Asset A's standard deviation and Asset B's standard deviation. O More than one of the above could be correct. The Frieza Co. just paid a dividend of $4 per share. They intend to increase the dividend to be paid in one year by 9%. After that, dividends will increase by 4% per year forever. If you require a 12% rate of return on your investment in the Frieza Co., how much should you pay for a share of this company's stock today? (Note: You are buying the stock immediately after the $4 dividend is paid.) Round only your final answer. Choose the range that includes the correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts