Question: A bond's current yield equals the bond's fixed annual interest payment divided by its bond price. It is a measure of the current annual income

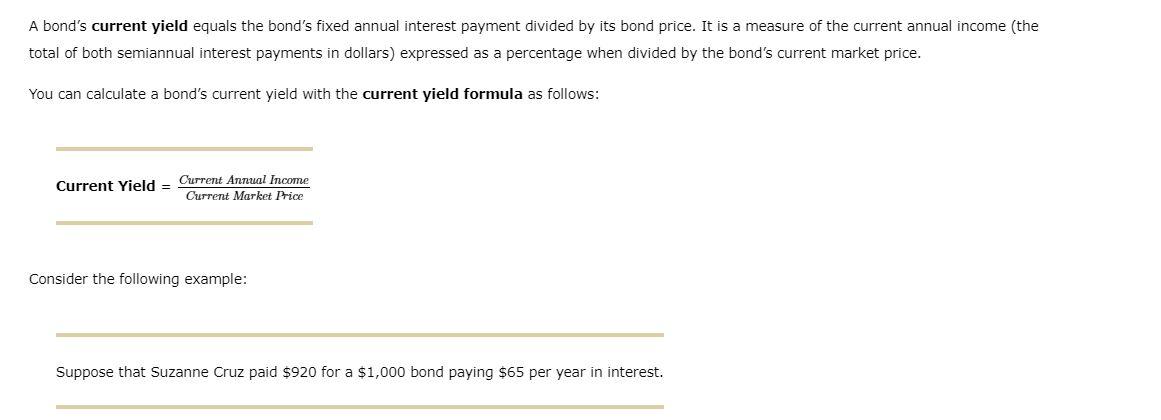

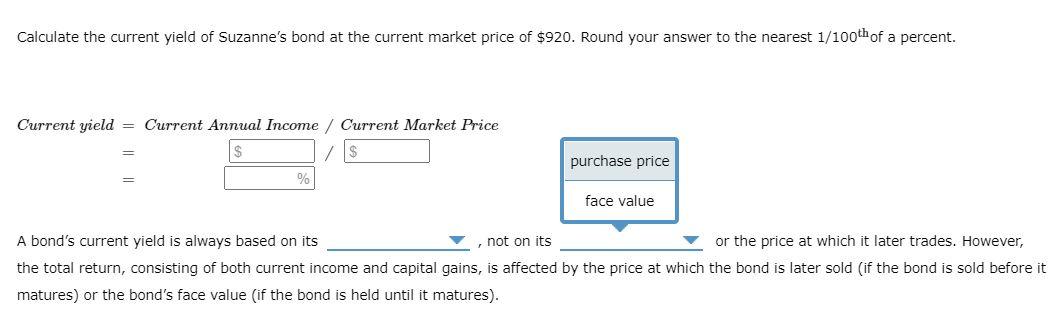

A bond's current yield equals the bond's fixed annual interest payment divided by its bond price. It is a measure of the current annual income (the total of both semiannual interest payments in dollars) expressed as a percentage when divided by the bond's current market price. You can calculate a bond's current yield with the current yield formula as follows: Current Yield = Current Annual Income Current Market Price Consider the following example: Suppose that Suzanne Cruz paid $920 for a $1,000 bond paying $65 per year in interest. Calculate the current yield of Suzanne's bond at the current market price of $920. Round your answer to the nearest 1/100th of a percent. Current yield = Current Annual Income / Current Market Price purchase price face value A bond's current yield is always based on its not on its or the price at which it later trades. However, the total return, consisting of both current income and capital gains, is affected by the price at which the bond is later sold (if the bond is sold before it matures) or the bond's face value (if the bond is held until it matures)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts