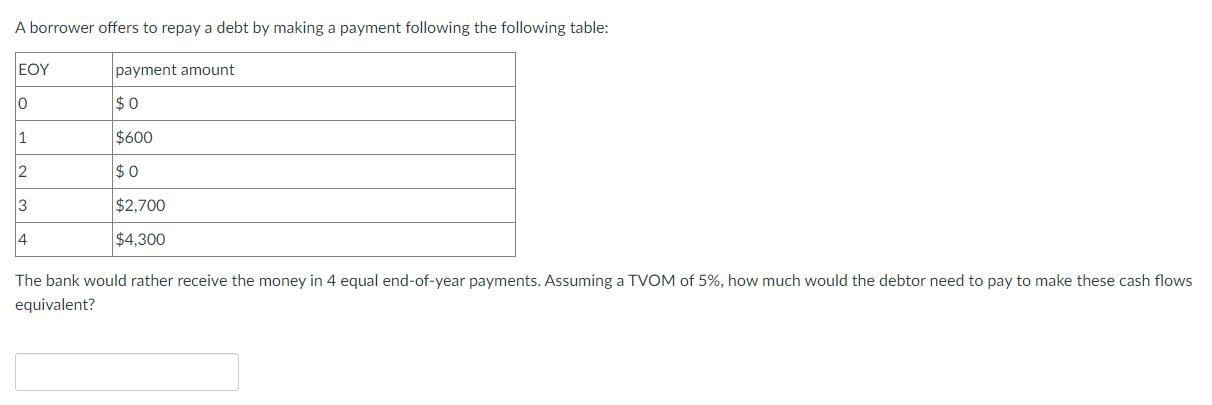

Question: A borrower offers to repay a debt by making a payment following the following table: 10 1 2 3 4 payment amount $0 $600

A borrower offers to repay a debt by making a payment following the following table: 10 1 2 3 4 payment amount $0 $600 $0 $2,700 $4,300 The bank would rather receive the money in 4 equal end-of-year payments. Assuming a TVOM of 5%, how much would the debtor need to pay to make these cash flows equivalent?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

To find the present value of the uneven cash flows we can discount each payment back to year 0 using ... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock