Question: a. Calculate Portfolio Ps expected return, and portfolio Qs expected return. b. Assume that CAPM holds true for the three stocks, meaning the expected returns

a. Calculate Portfolio Ps expected return, and portfolio Qs expected return.

a. Calculate Portfolio Ps expected return, and portfolio Qs expected return.

b. Assume that CAPM holds true for the three stocks, meaning the expected returns of each stock truly reflects the level of risk embedded in it. Which stock has the highest systematic risk?

c. Calculate each portfolios total risks. Comment on the comparative total risks of Portfolio P and Portfolio Q.

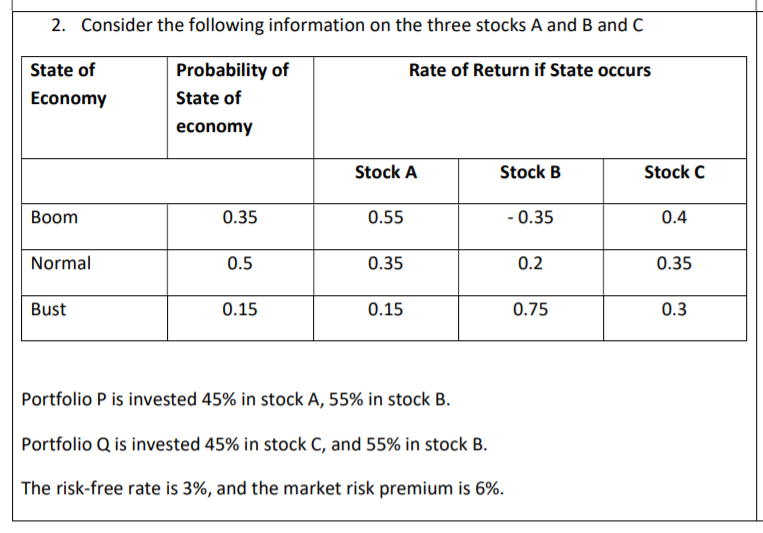

2. Consider the following information on the three stocks A and B and C State of Rate of Return if State occurs Probability of State of Economy economy Stock A Stock B Stock C Boom 0.35 0.55 -0.35 0.4 Normal 0.5 0.35 0.2 0.35 Bust 0.15 0.15 0.75 0.3 Portfolio P is invested 45% in stock A, 55% in stock B. Portfolio Q is invested 45% in stock C, and 55% in stock B. The risk-free rate is 3%, and the market risk premium is 6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts