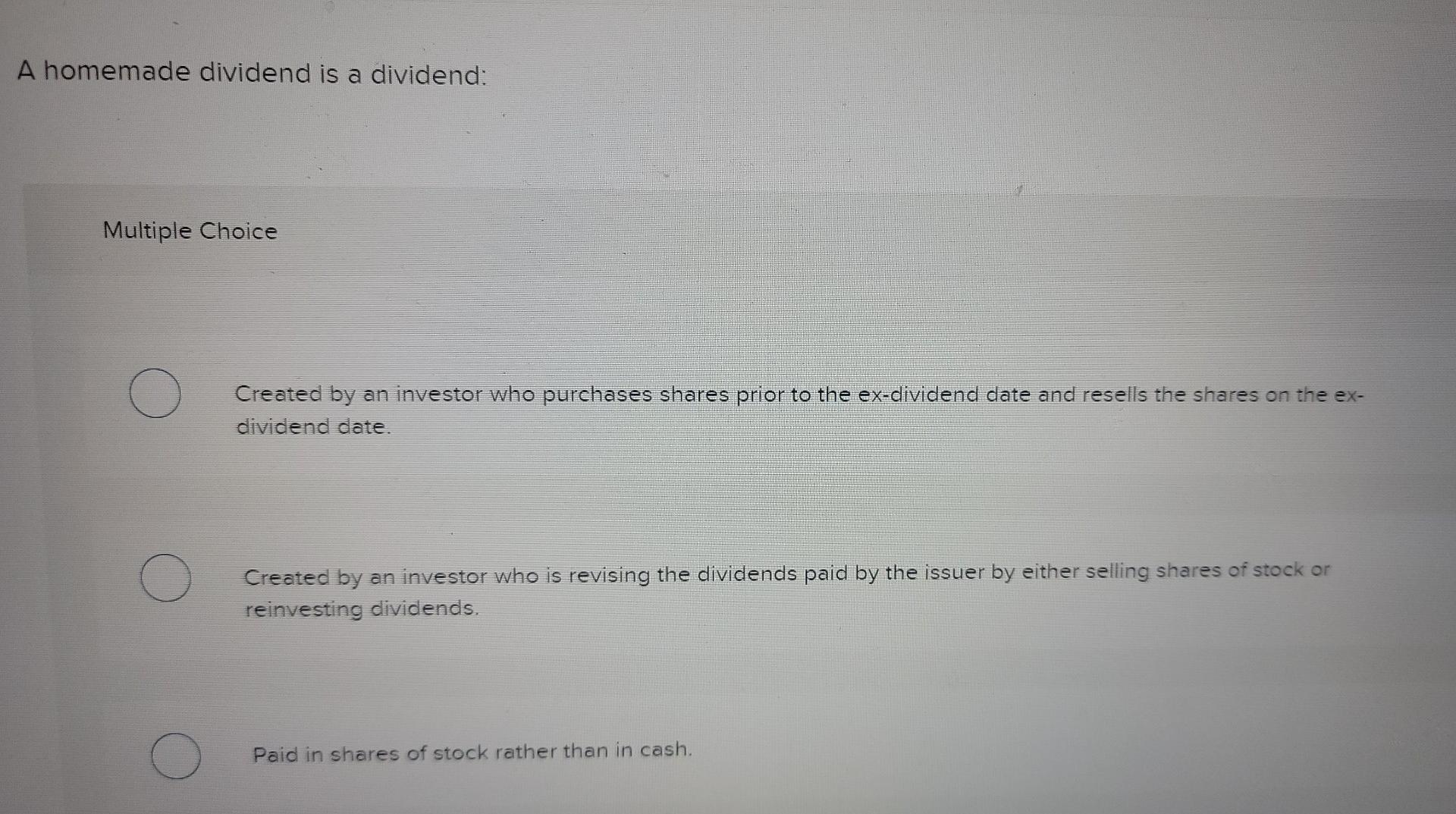

Question: A homemade dividend is a dividend: Multiple Choice Created by an investor who purchases shares prior to the ex-dividend date and resells the shares on

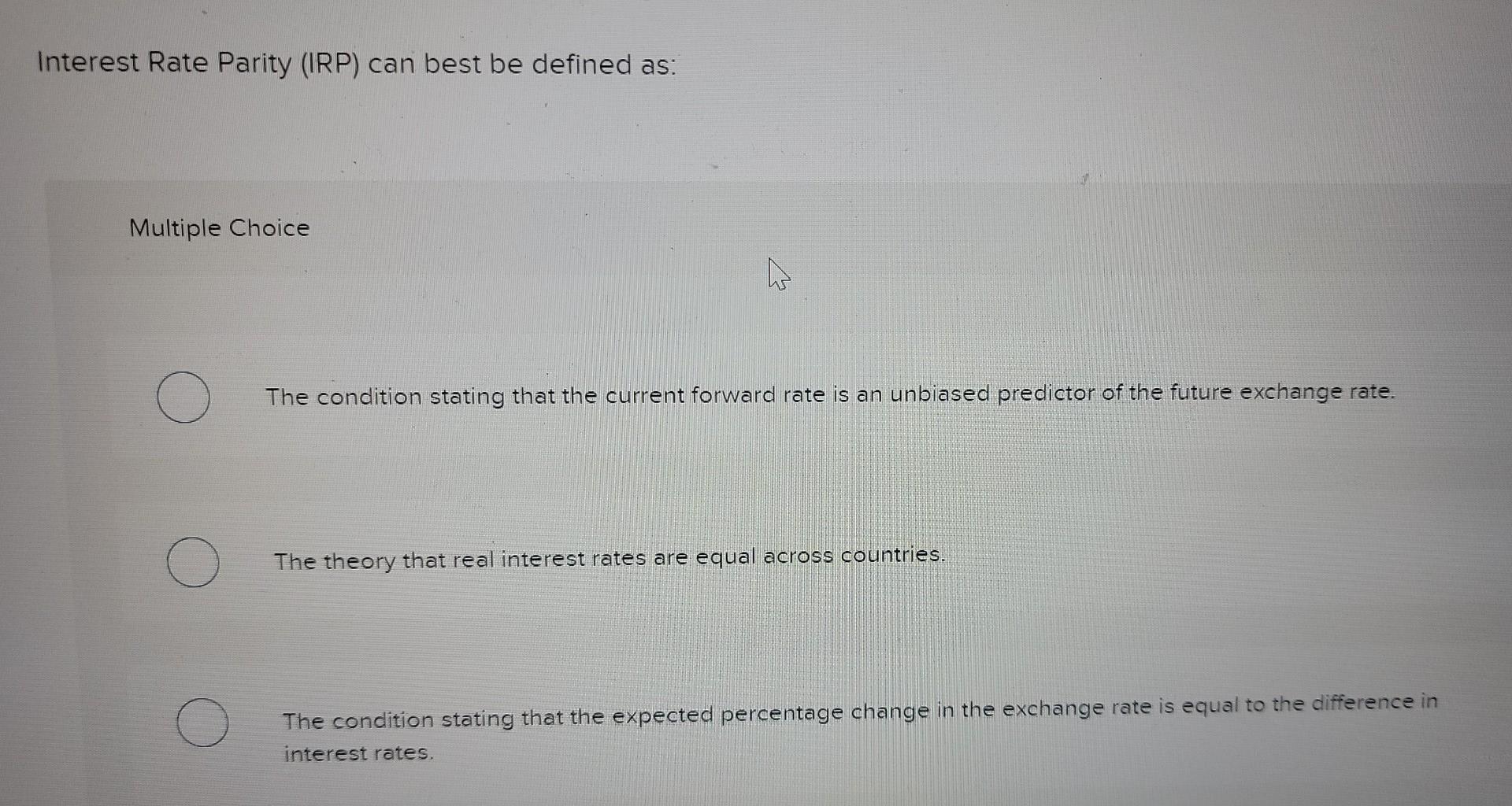

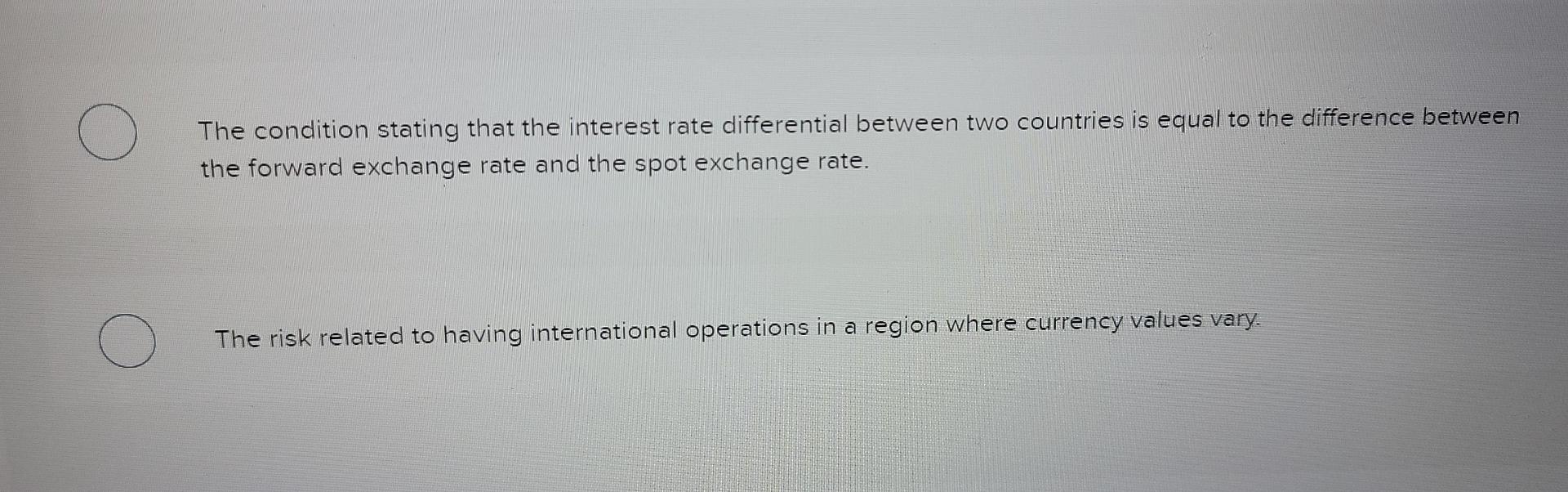

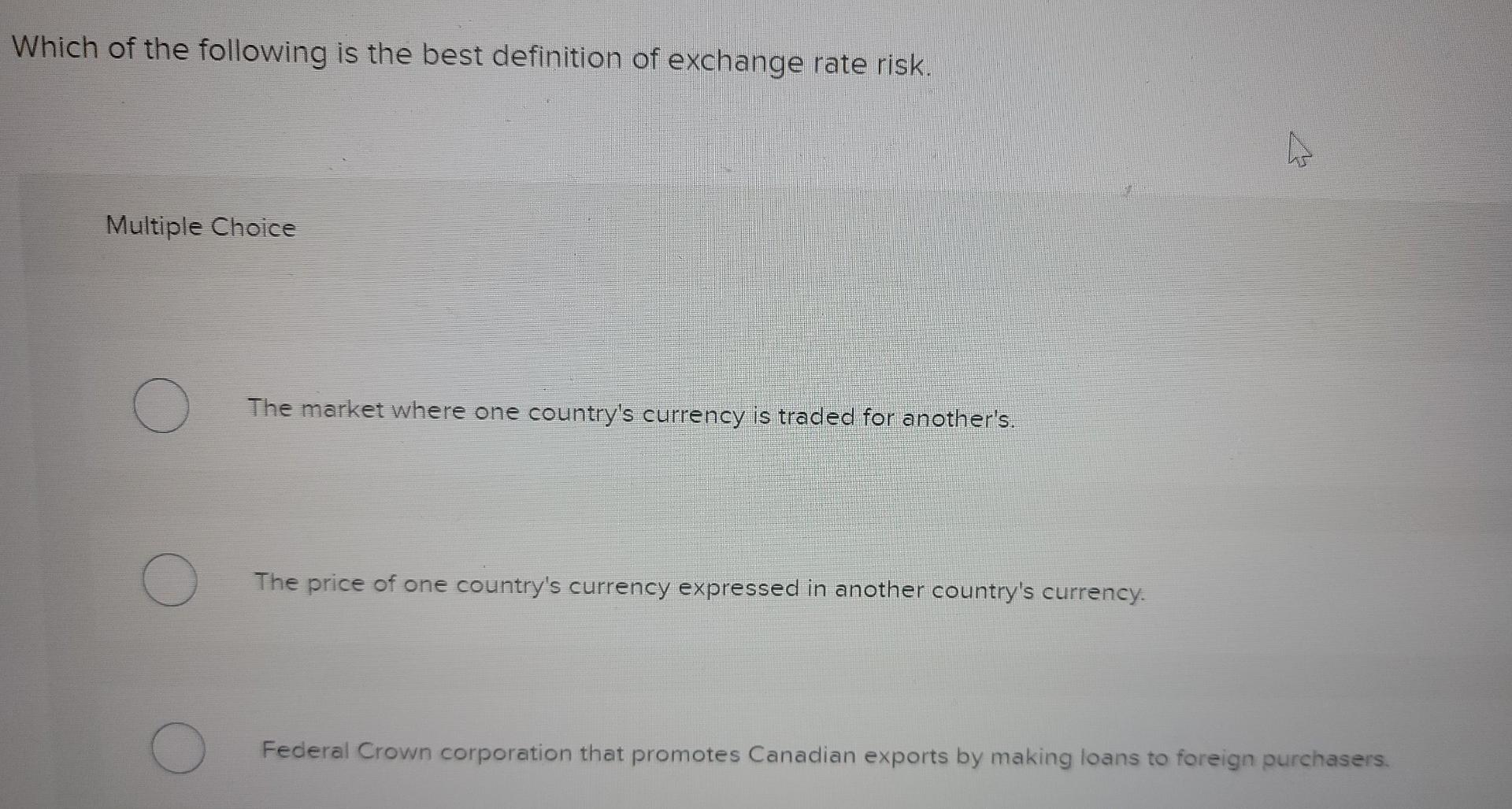

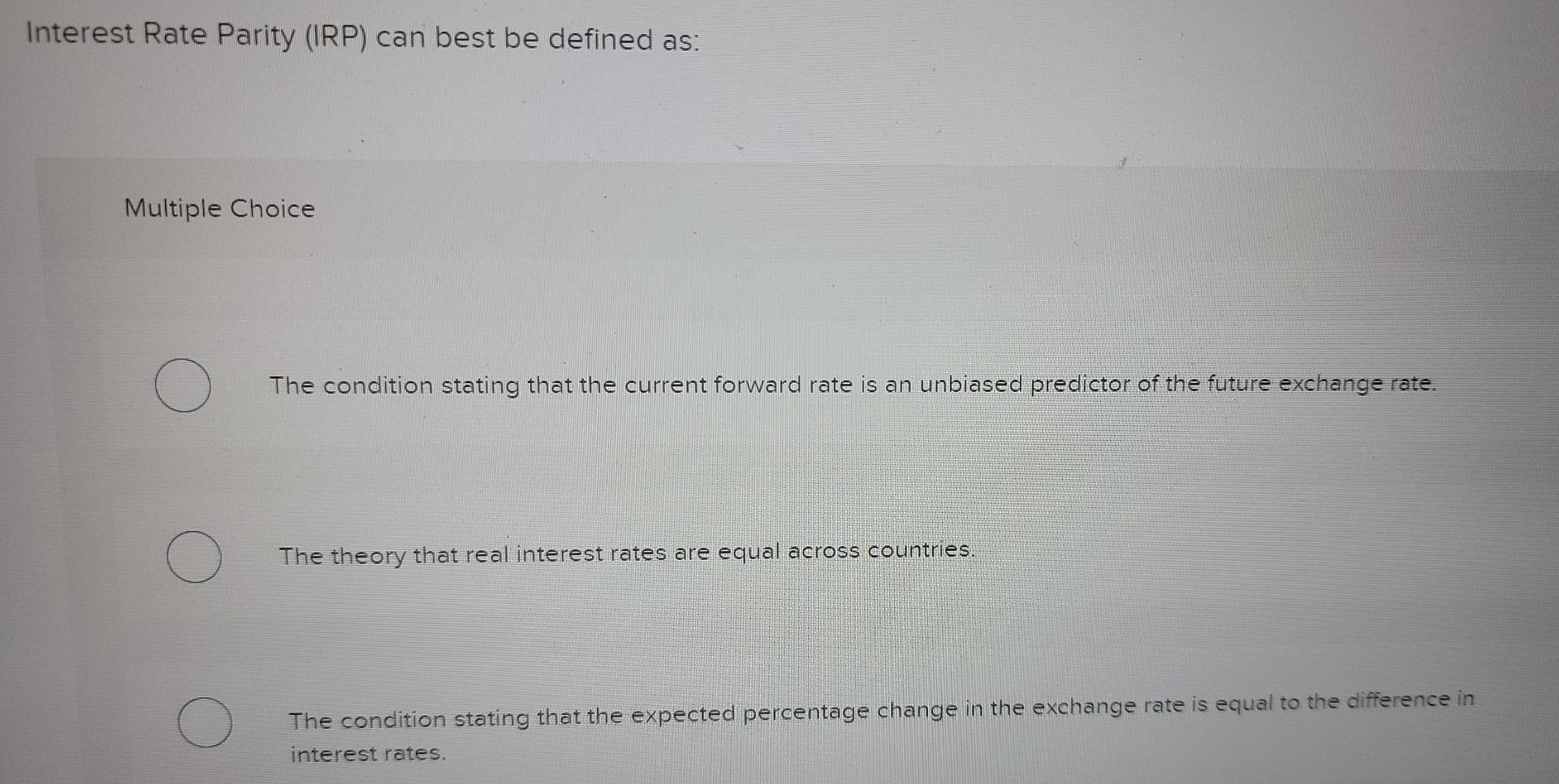

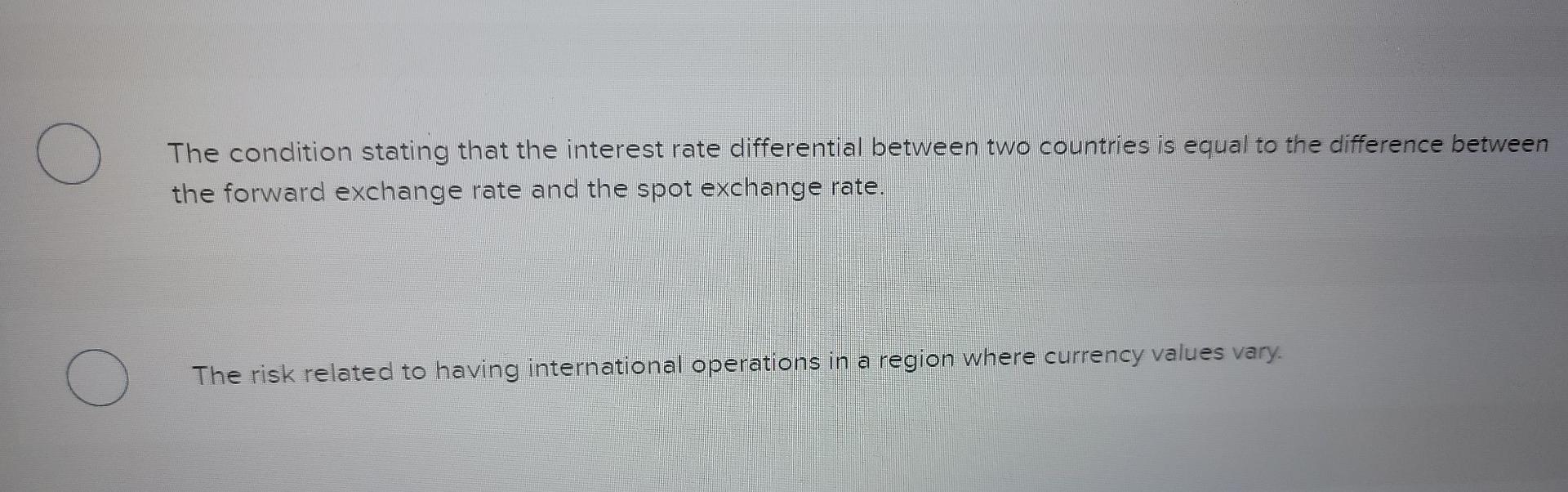

A homemade dividend is a dividend: Multiple Choice Created by an investor who purchases shares prior to the ex-dividend date and resells the shares on the ex- dividend date. Created by an investor who is revising the dividends paid by the issuer by either selling shares of stock or reinvesting dividends. Paid in shares of stock rather than in cash. Created by adding options to an equity position. Paid on convertible bonds. Interest Rate Parity (IRP) can best be defined as: Multiple Choice the O The condition stating that the current forward rate is an unbiased predictor of the future exchange rate. O The theory that real interest rates are equal across countries. O The condition stating that the expected percentage change in the exchange rate is equal to the difference in interest rates. The condition stating that the interest rate differential between two countries is equal to the difference between the forward exchange rate and the spot exchange rate. The risk related to having international operations in a region where currency values vary. Which of the following is the best definition of exchange rate risk. b Multiple Choice O The market where one country's currency is traded for another's. The price of one country's currency expressed in another country's currency. Federal Crown corporation that promotes Canadian exports by making loans to foreign purchasers. O O The idea that the exchange rate adjusts to keep purchasing power constant among currencies. O International bonds issued in a single country, usually denominated in that country's currency. Interest Rate Parity (IRP) can best be defined as: Multiple Choice O The condition stating that the current forward rate is an unbiased predictor of the future exchange rate. The theory that real interest rates are equal across countries. The condition stating that the expected percentage change in the exchange rate is equal to the difference in interest rates. () The condition stating that the interest rate differential between two countries is equal to the difference between the forward exchange rate and the spot exchange rate. The risk related to having international operations in a region where currency values vary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts