Question: A. Calculate the average rolling returns for the hedge fund if the investors investment horizon is nine months. B. Explain how rolling returns can provide

A. Calculate the average rolling returns for the hedge fund if the investors investment horizon is nine months.

B. Explain how rolling returns can provide additional information about the hedge funds performance.

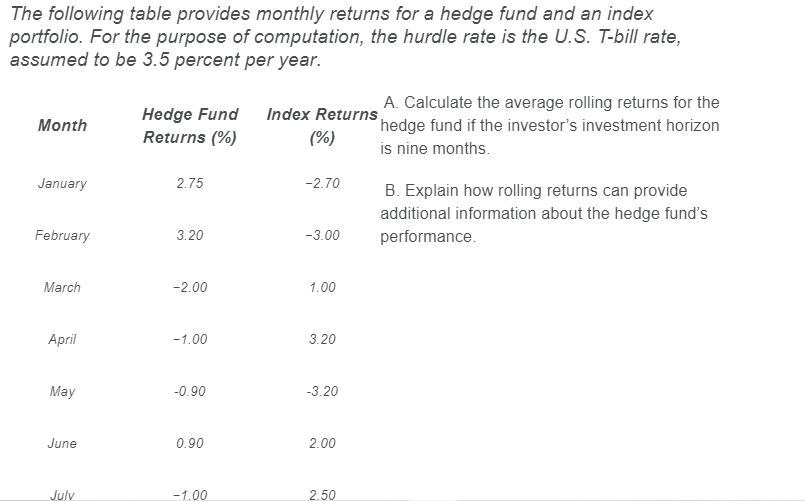

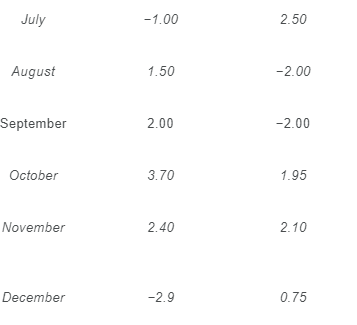

The following table provides monthly returns for a hedge fund and an index portfolio. For the purpose of computation, the hurdle rate is the U.S. T-bill rate, assumed to be 3.5 percent per year. Month Hedge Fund Index Returns A. Calculate the average rolling returns for the hedge fund if the investor's investment horizon Returns (%) (%) is nine months. January 2.75 -2.70 B. Explain how rolling returns can provide additional information about the hedge fund's performance. February 3.20 -3.00 March -2.00 1.00 April -1.00 3.20 May -0.90 -3.20 June 0.90 2.00 July -1.00 2.50 July -1.00 2.50 August 1.50 -2.00 September 2.00 -2.00 October 3.70 1.95 November 2.40 2.10 December -2.9 0.75 The following table provides monthly returns for a hedge fund and an index portfolio. For the purpose of computation, the hurdle rate is the U.S. T-bill rate, assumed to be 3.5 percent per year. Month Hedge Fund Index Returns A. Calculate the average rolling returns for the hedge fund if the investor's investment horizon Returns (%) (%) is nine months. January 2.75 -2.70 B. Explain how rolling returns can provide additional information about the hedge fund's performance. February 3.20 -3.00 March -2.00 1.00 April -1.00 3.20 May -0.90 -3.20 June 0.90 2.00 July -1.00 2.50 July -1.00 2.50 August 1.50 -2.00 September 2.00 -2.00 October 3.70 1.95 November 2.40 2.10 December -2.9 0.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts