Question: PLEASE SHOW YOUR WORK! The following table provides monthly returns for a hedge fund and an index portfolio. For the purpose of computation, the hurdle

PLEASE SHOW YOUR WORK!

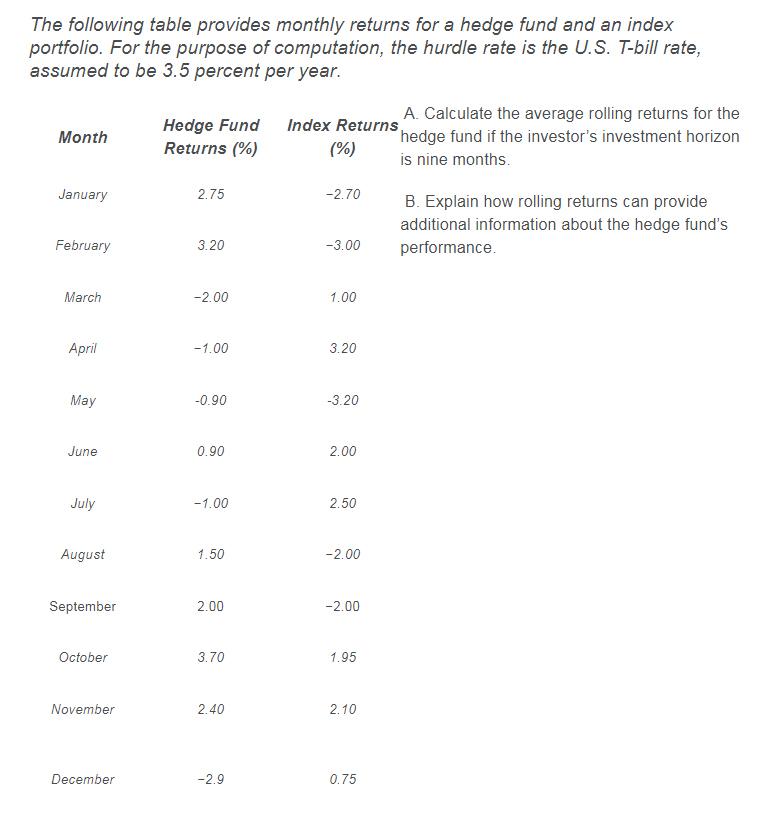

The following table provides monthly returns for a hedge fund and an index portfolio. For the purpose of computation, the hurdle rate is the U.S. T-bill rate, assumed to be 3.5 percent per year. A. Calculate the average rolling returns for the Hedge Fund Index Returns Month hedge fund if the investor's investment horizon Returns (%) (%) is nine months. January 2.75 -2.70 B. Explain how rolling returns can provide additional information about the hedge fund's performance February 3.20 -3.00 March -2.00 1.00 April -1.00 3.20 May -0.90 -3.20 June 0.90 2.00 July -1.00 2.50 August 1.50 -2.00 September 2.00 -2.00 October 3.70 1.95 November 2.40 2.10 December -2.9 0.75 The following table provides monthly returns for a hedge fund and an index portfolio. For the purpose of computation, the hurdle rate is the U.S. T-bill rate, assumed to be 3.5 percent per year. A. Calculate the average rolling returns for the Hedge Fund Index Returns Month hedge fund if the investor's investment horizon Returns (%) (%) is nine months. January 2.75 -2.70 B. Explain how rolling returns can provide additional information about the hedge fund's performance February 3.20 -3.00 March -2.00 1.00 April -1.00 3.20 May -0.90 -3.20 June 0.90 2.00 July -1.00 2.50 August 1.50 -2.00 September 2.00 -2.00 October 3.70 1.95 November 2.40 2.10 December -2.9 0.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts