Question: (a) Calculate the expected return for Company A, which has a beta of 1.75 when the risk free rate is 0.03 and you expect return

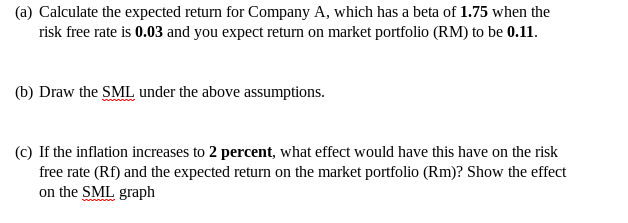

(a) Calculate the expected return for Company A, which has a beta of 1.75 when the risk free rate is 0.03 and you expect return on market portfolio (RM) to be 0.11 (b) Draw the SML under the above assumptions. (c) If the inflation increases to 2 percent, what effect would have this have on the risk free rate (Rf) and the expected return on the market portfolio (Rm)? Show the effect on the SML graph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts