Question: A callable bond is a bond that can be redeemed by the issuer prior to its maturity. If interest rates have declined since the company

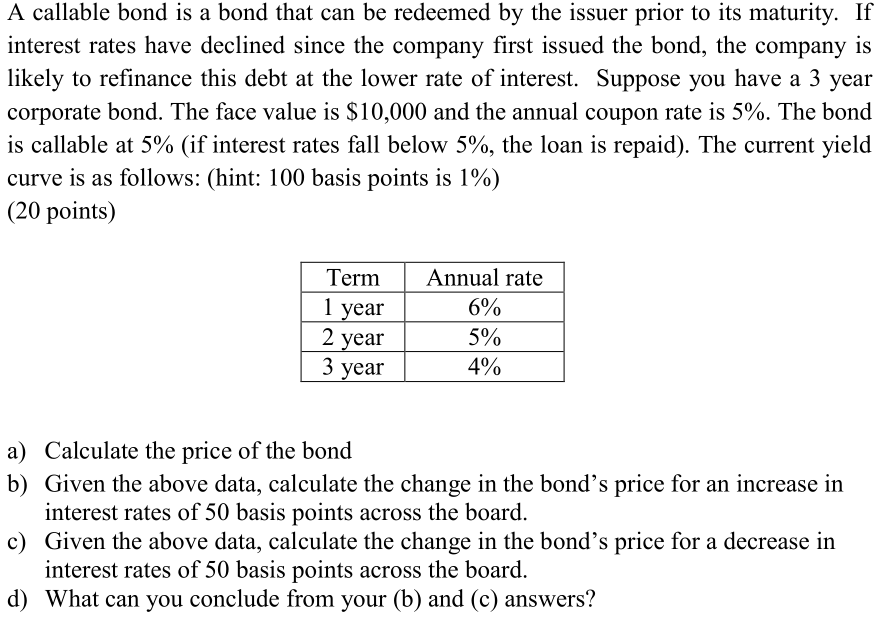

A callable bond is a bond that can be redeemed by the issuer prior to its maturity. If interest rates have declined since the company first issued the bond, the company is likely to refinance this debt at the lower rate of interest. Suppose you have a 3 year corporate bond. The face value is $10,000 and the annual coupon rate is 5%. The bond is callable at 5% (if interest rates fall below 5%, the loan is repaid). The current yield curve is as follows: (hint: 100 basis points is 1%) (20 points) Term 1 year 2 year 3 year Annual rate 6% 5% 4% a) Calculate the price of the bond b) Given the above data, calculate the change in the bond's price for an increase in interest rates of 50 basis points across the board. c) Given the above data, calculate the change in the bond's price for a decrease in interest rates of 50 basis points across the board. d) What can you conclude from your (b) and (c) answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts