Question: A. Capital Gains/Loss between two consecutive periods B. Current Yield between Two Consecutive Periods C. Finding period 1's price of a stock with super-normal growth

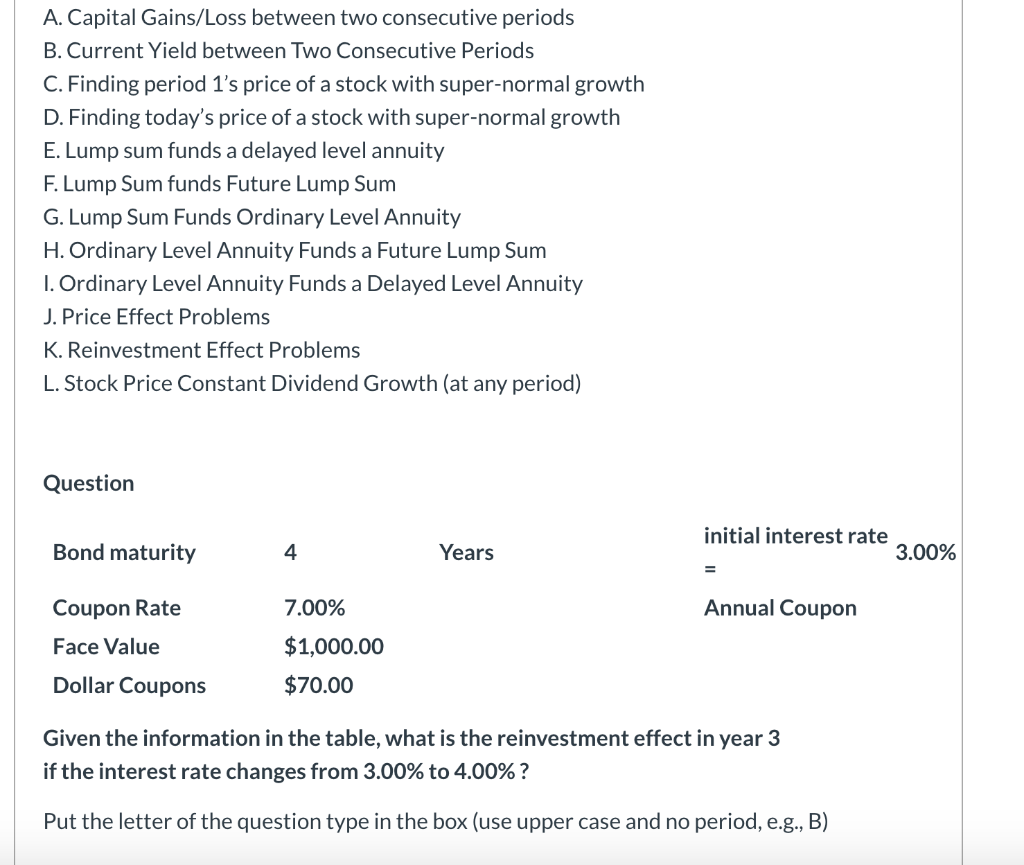

A. Capital Gains/Loss between two consecutive periods B. Current Yield between Two Consecutive Periods C. Finding period 1's price of a stock with super-normal growth D. Finding today's price of a stock with super-normal growth E. Lump sum funds a delayed level annuity F. Lump Sum funds Future Lump Sum G. Lump Sum Funds Ordinary Level Annuity H. Ordinary Level Annuity Funds a Future Lump Sum I. Ordinary Level Annuity Funds a Delayed Level Annuity J. Price Effect Problems K. Reinvestment Effect Problems L. Stock Price Constant Dividend Growth (at any period) Question initial interest rate 3.00% Bond maturity 4. Years Annual Coupon Coupon Rate Face Value Dollar Coupons 7.00% $1,000.00 $70.00 Given the information in the table, what is the reinvestment effect in year 3 if the interest rate changes from 3.00% to 4.00%? Put the letter of the question type in the box (use upper case and no period, e.g., B)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts