Question: A certain factory building has an old lighting system. Lighting the building currently costs, on average, $27,000 a year. A lighting consultant tells the factory

A certain factory building has an old lighting system. Lighting the building currently costs, on average, $27,000 a year. A lighting consultant tells the factory supervisor that the lighting bill can be reduced to $6,000 a year if $46,000 is invested in new lighting in the building. If the new lighting system is installed, an incremental maintenance cost of $5,000 per year must be taken into account. The new lighting system has zero salvage value at the end of its life. If the old lighting system also has zero salvage value, and the new lighting system is estimated to have a life of 15 years, what is the net annual benefit for this investment in new lighting? Take the MARR to be 13%. Assume the old lighting system will last 15 years.

The annual savings from installing the new lighting system

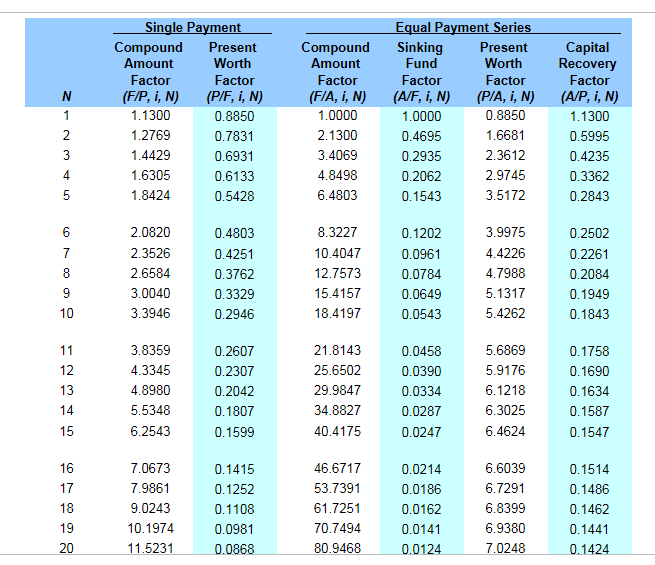

10 11 12 13 14 15 16 17 18 19 20 Single Payment Equal Payment Series Compound Present Compound Sinking Present Capital Fund Amount Worth Amount Worth Recovery Factor Factor Factor Factor Factor Factor (F/P, i, N) (P/F, i, N) (FA, i, N) (A/F, i, N) (PA, i, N) (A/P, i, N) 1.1300 1.0000 0.8850 0.8850 1.0000 1.1300 2769 2.1300 6681 0.7831 4695 0.5995 0.4235 4429 3.4069 2.3612 0.6931 0.2935 6305 4.8498 2.9745 0.6133 0.2062 0.3362 1.8424 6.4803 3.5172 0.5428 0.1543 0.2843 2.0820 10.4047 0.0961 2.3526 0.4251 12.7573 0.0784 2.6584 15.4157 0.0649 18.4197 0.0543 21.8143 0.0458 3.8359 5.6869 0.2607 0.1758 4.3345 25.6502 0.0390 5.9176 0.2307 0.1690 29.9847 0.0334 4.8980 6.1218 0.2042 0.1634 34.8827 0.0287 5.5348 6.3025 0.1807 0.1587 6.4624 6.2543 40.4175 0.0247 0.1599 0.1547 46.6717 7.0673 6.6039 0.1415 0.0214 0.1514 7.9861 53.7391 6.7291 0.1 252 0.0186 0.1 486 61.7251 9.0243 6.8399 0.1108 0.0162 0.1462 70.7494 10.1974. 6.9380 0.0981 0.014 0.144 11.5231 0.0868 80.9468 7.0248 0.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts