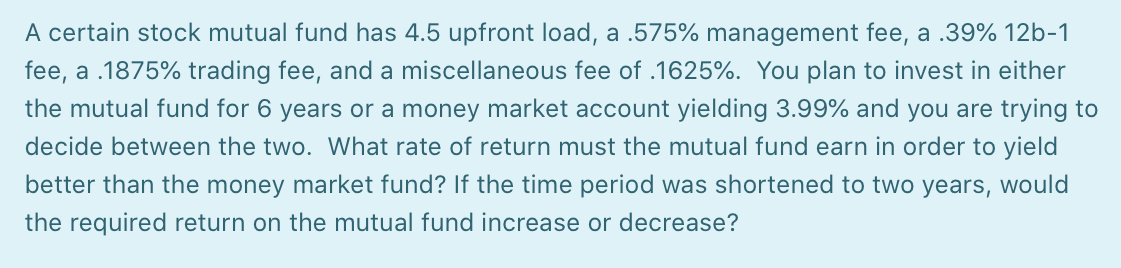

Question: A certain stock mutual fund has 4.5 upfront load, a .575% management fee, a .39% 12b-1 fee, a .1875% trading fee, and a miscellaneous fee

A certain stock mutual fund has 4.5 upfront load, a .575% management fee, a .39% 12b-1 fee, a .1875% trading fee, and a miscellaneous fee of .1625%. You plan to invest in either the mutual fund for 6 years or a money market account yielding 3.99% and you are trying to decide between the two. What rate of return must the mutual fund earn in order to yield better than the money market fund? If the time period was shortened to two years, would the required return on the mutual fund increase or decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts