Question: A city is interested in developing a lake front property into a sports park (picnic facilities, boat docks, swimming area, etc.). A consultant has estimated

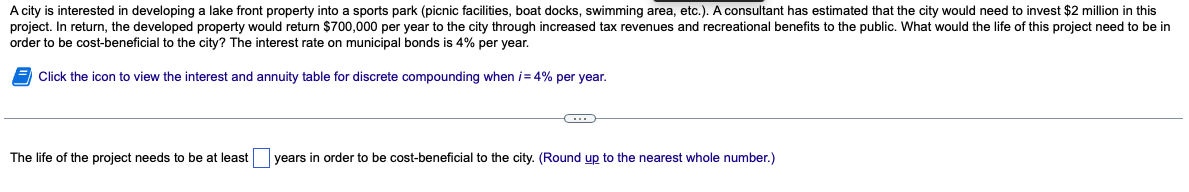

A city is interested in developing a lake front property into a sports park (picnic facilities, boat docks, swimming area, etc.). A consultant has estimated that the city would need to invest $2 million in this project. In return, the developed property would return $700,000 per year to the city through increased tax revenues and recreational benefits to the public. What would the life of this project need to be in order to be cost-beneficial to the city? The interest rate on municipal bonds is 4% per year. Click the icon to view the interest and annuity table for discrete compounding when i=4% per year. C The life of the project needs to be at least years in order to be cost-beneficial to the city. (Round up to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts