Question: Q3. Camry Inc. produce 3 grades of car seat covers, Basic, Deluxe and Super. Each seat cover is manufactured using a different grade of

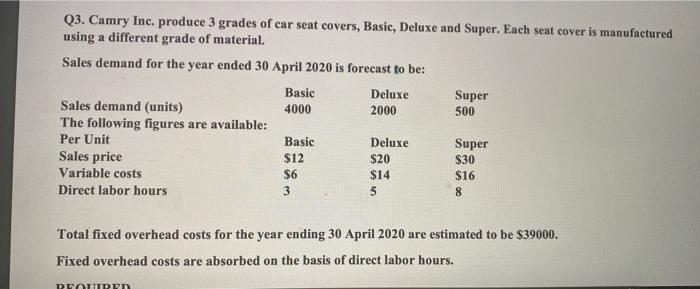

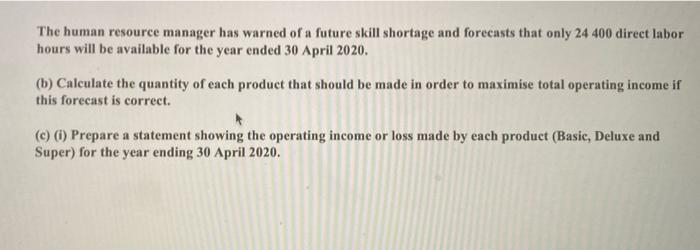

Q3. Camry Inc. produce 3 grades of car seat covers, Basic, Deluxe and Super. Each seat cover is manufactured using a different grade of material. Sales demand for the year ended 30 April 2020 is forecast to be: Sales demand (units) The following figures are available: Per Unit Sales price Variable costs Direct labor hours Basic 4000 REQUIRED Basic $12 $6 3 Deluxe 2000 Deluxe $20 $14 5 Super 500 Super $30 $16 8 Total fixed overhead costs for the year ending 30 April 2020 are estimated to be $39000. Fixed overhead costs are absorbed on the basis of direct labor hours. The human resource manager has warned of a future skill shortage and forecasts that only 24 400 direct labor hours will be available for the year ended 30 April 2020. (b) Calculate the quantity of each product that should be made in order to maximise total operating income if this forecast is correct. (c) (i) Prepare a statement showing the operating income or loss made by each product (Basic, Deluxe and Super) for the year ending 30 April 2020.

Step by Step Solution

3.46 Rating (143 Votes )

There are 3 Steps involved in it

I II III IV ANSWER B ANSWER C Calculation of Total direct labour hours requ... View full answer

Get step-by-step solutions from verified subject matter experts