Question: A class B - / C office building located in a Class A location in mid - town Phoenix constructed in 1 9 6 0

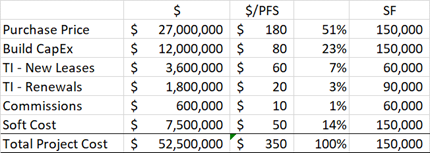

A class BC office building located in a Class A location in midtown Phoenix constructed in is vacant. Market vacancy is for Class A buildings and for class B The prospective new Buyer is under contract to buy this property for $ million. The gross area of the property is SF distributed on ten floors. The investor wants to reposition the property into a Class AB office building and sell it once stabilized within years.

What kind of loan would you select for this property a CMBS conduit loan or one from a Portfolio Lender? Explain what were the main factors that influenced your choice use bullet point format

Select all the correct statements:

CMBS loans regularly require personal guarantees from the sponsors while Portfolio loans are mostly nonrecourse

Portfolio loans usually have higher interest rates and lower LTVs than CMBS loans

The Master Servicer in a CMBS loan is the party that looks to maximize recover for the shareholders which may include foreclosure

If there are delays in the execution of the reposition plan, a Portfolio lender is more likely to modify the loan to address a potential default

If the property is sold earlier than anticipated its easy and relatively affordable to prepay a CMBS loan, whereas a Portfolio loan usually have expensive defeasance process

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock