Question: A collared floater is like a variable rate bond, but with an upper limit and a lower limit on the rate of coupon payment. Consider,

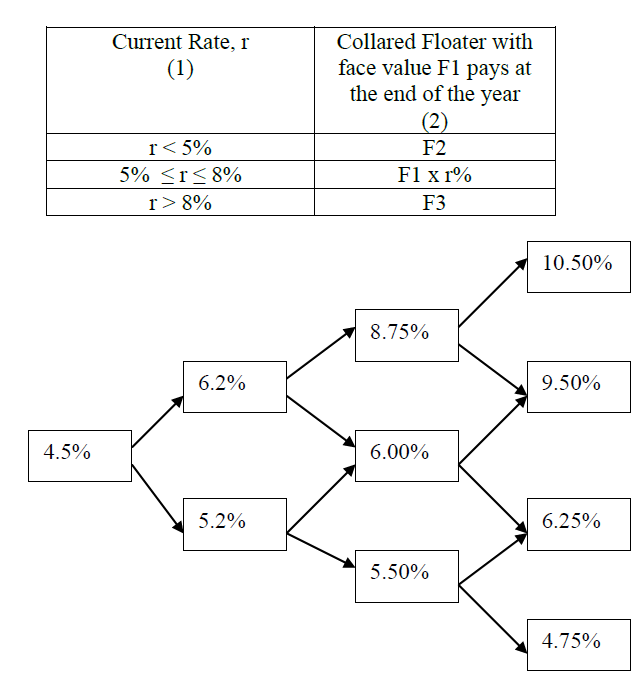

A collared floater is like a variable rate bond, but with an upper limit and a lower limit on the rate of coupon payment. Consider, for example, annual rates coupon payment and one-year spot interest rates. In the following table, the current one-year spot interest rate is denoted by r in column (1). Depending on the current spot interest rate, the collared floater with a face value of F1 dollars will pay the holder of this floater a sum a year later, as given in column (2) of the table. The binomial tree below gives the evolution of one-year spot interest rates over a four year period. F1 = 880; F2 = 44; F3 = 70.4 22. What is the current fair value of the four-year collared floater if the risk-neutral probabilities in the binomial tree are 0.5 and 0.5 for the up and down moves, respectively?

Collared Floater with face value F1 pays at the end of the year Current Rate, r 8% F2 F1 x1% F3 10.50% 8.75% 6.2% 9.50% 4.5% 6.00% 5.2% 6.25% 5.50% 4.75% Collared Floater with face value F1 pays at the end of the year Current Rate, r 8% F2 F1 x1% F3 10.50% 8.75% 6.2% 9.50% 4.5% 6.00% 5.2% 6.25% 5.50% 4.75%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts