Question: a. Commonly hedge funds charge a fixed fee as a percentage share of their net asset value, plus an incentive fee, which is often calculated

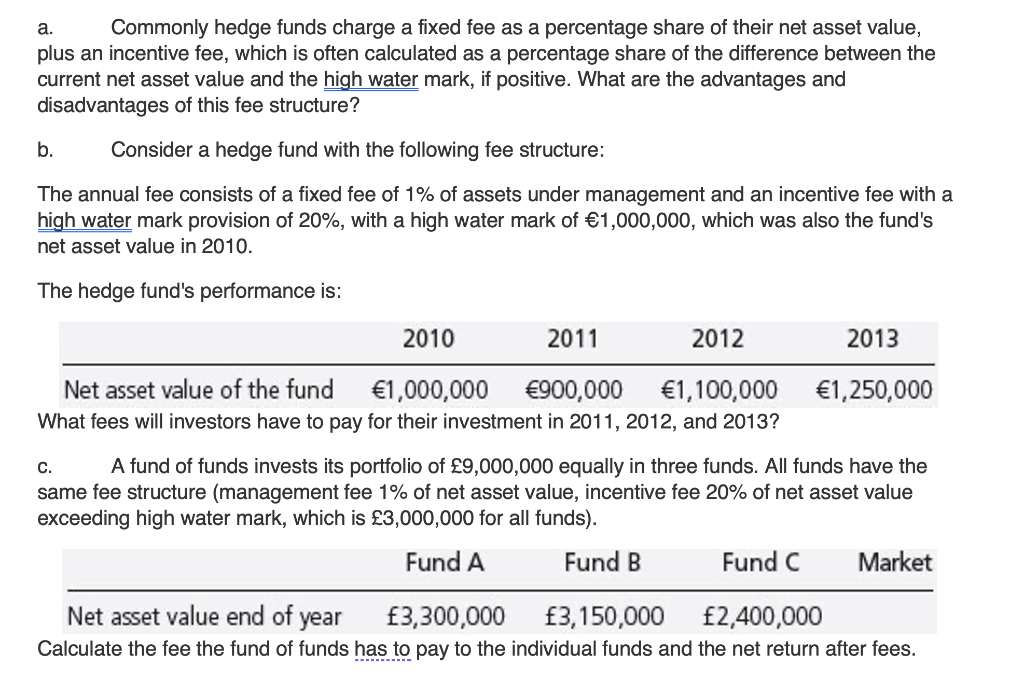

a. Commonly hedge funds charge a fixed fee as a percentage share of their net asset value, plus an incentive fee, which is often calculated as a percentage share of the difference between the current net asset value and the high water mark, if positive. What are the advantages and disadvantages of this fee structure? b. Consider a hedge fund with the following fee structure: The annual fee consists of a fixed fee of 1% of assets under management and an incentive fee with a high water mark provision of 20%, with a high water mark of 1,000,000, which was also the fund's net asset value in 2010. The hedge fund's performance is: What fees will investors have to pay for their investment in 2011, 2012, and 2013? c. A fund of funds invests its portfolio of 9,000,000 equally in three funds. All funds have the same fee structure (management fee 1% of net asset value, incentive fee 20% of net asset value exceeding high water mark, which is 3,000,000 for all funds). Calculate the fee the fund of funds has to pay to the individual funds and the net return after fees

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts