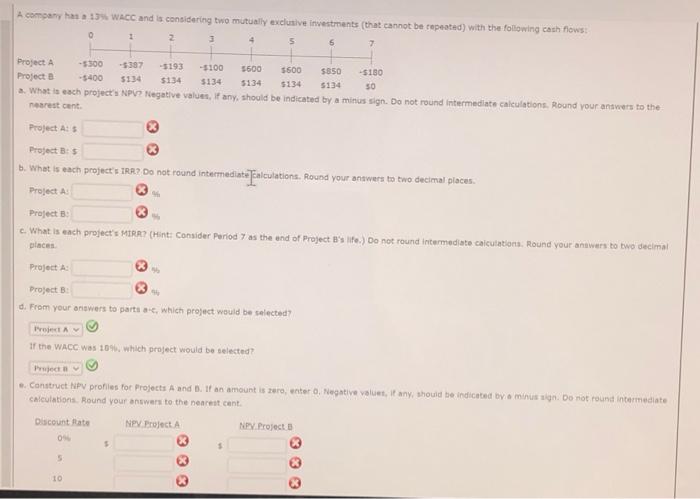

Question: A company has 1 WACC and is considering two mutually exclusive investments that cannot be repeated) with the following cash rows 0 3 2 3

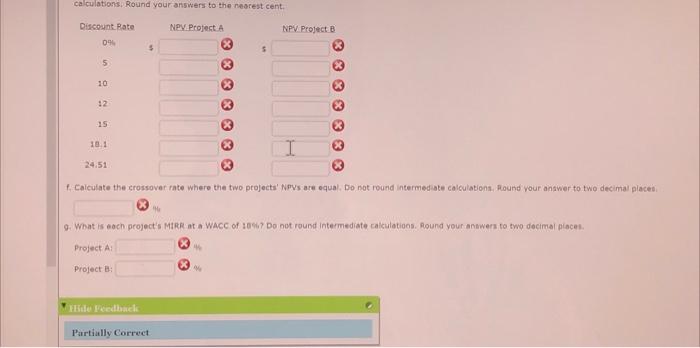

A company has 1 WACC and is considering two mutually exclusive investments that cannot be repeated) with the following cash rows 0 3 2 3 4 5 5 7 Project A -5300 --5387 -5193 -$100 5600 5600 $850 -$150 Project -$400 5134 $134 $134 5134 $134 5134 50 What is each project's NPV? Negative values, if any, should be indicated by a minus sign. Do not round Intermediate calculations. Round your answers to the nearest cent Project AS Project : $ b. What is each project's IRR? Do not found intermediate Inculations. Round your answers to two decimal places. Project Project : c. What is each project's MIRA? (Hint: Consider Period 7 as the end of Project B's 11.) Do not round intermediate calculations. Round your answers to two decimal places Project A Project B: d. From your answers to parts, which project would be selected? Project If the WACC was 10% which project would be selected? Pet .. Construct NPV profiles for Projects A and B. If an amount is zero, entero Negative values, it any, should be indicated by a minus in. Do not round Intermediate calculations. Round your answers to the nearest cent. Discount Rate Ney Project NPV Project 0 5 $ % * * 10 calculations, Round your answers to the nearest cent Discount Rate NPV Project. A NPV Project B 09 $ 5 10 12 3 3 $ $ $ $ 8 8 8 8 8 8 83 15 10.1 24.51 1. Calculate the crossover rate where the two projects' NPVs are equal. Do not round Intermediate calculations, Round your answer to two decimal places Q. What is each project's MtRate WACC of 1097 Do not round intermediate calculations. Round your answers to two decimal places. Project Al Project File Feedback Partially Correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts