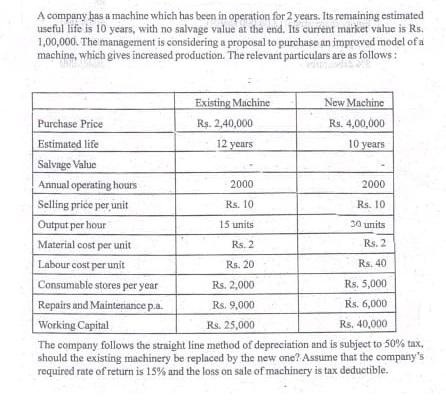

Question: A company has a machine which has been in operation for 2 years. Its remaining estimated useful life is 10 years, with no salvage value

A company has a machine which has been in operation for 2 years. Its remaining estimated useful life is 10 years, with no salvage value at the end. Its current market value is Rs. 1,00,000. The management is considering a proposal to purchase an improved model of a machine, which gives increased production. The relevant particulars are as follows: 10 years Existing Machine Now Machine Purchase Price Rs. 2,40,000 Rs. 4,00,000 Estimated life 12 years Salvnge Value Annual operating holars 2000 2000 Selling price per unit Rs. 10 Rs. 10 Output per hour 15 units 30 units Material cost per unit Rs. 2 Rs. 2 Labour cost per unit Rs. 20 Rs. 40 Consumable stores per year Rs. 2,000 Rs. 5,000 Repairs and Maintenance p.a. Rs.9.000 Rs. 6,000 Working Capital Rs. 25,000 Rs. 40,000 The company follows the strnight line method of depreciation and is subject to 50% tax, should the existing machinery be replaced by the new one? Assume that the company's required rate of return is 15% and the loss on sale of machinery is tax deductible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts