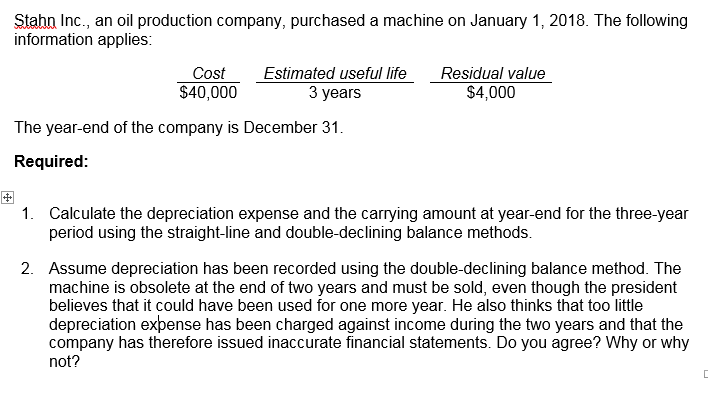

Question: Stann Inc., an oil production company, purchased a machine on January 1, 2018. The following information applies. Cost $40,000 Estimated useful life 3 years

Stann Inc., an oil production company, purchased a machine on January 1, 2018. The following information applies. Cost $40,000 Estimated useful life 3 years Residual value $4,000 The year-end of the company is December 31 Required: 2. Calculate the depreciation expense and the carrying amount at year-end for the three-year period using the straight-line and double-declining balance methods. Assume depreciation has been recorded using the double-declining balance method. The machine is obsolete at the end of two years and must be sold, even though the president believes that it could have been used for one more year. He also thinks that too little depreciation exbense has been charged against income during the two years and that the company has therefore issued inaccurate financial statements. Do you agree? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts