Question: A company has a machine which will continue to function for the next five years, but gradually become less productive. Free cash flows for the

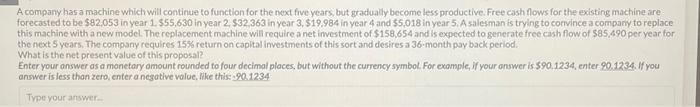

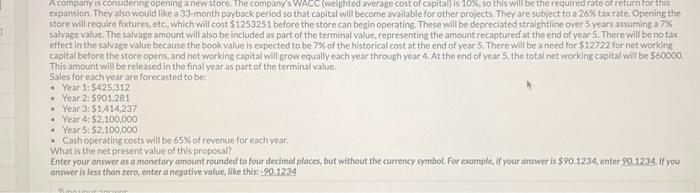

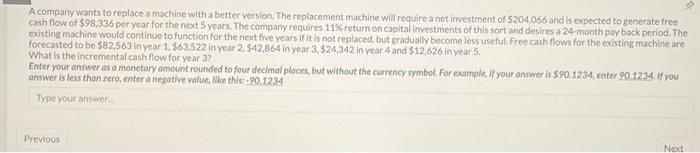

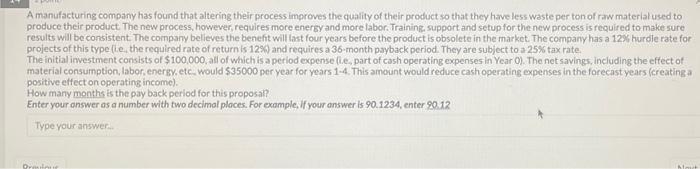

A company has a machine which will continue to function for the next five years, but gradually become less productive. Free cash flows for the existing machine are forecasted to be $92,053 in year 1,555,630 in year 2,532,363 in year 3,519,984 in year 4 and 55,018 in year 5 , A salerman is thying to comvince a company to replace this machine with a new model. The replacement machine will require a net imvestment of $158,654 and is expected to generate free cash flow of $85,490 per year for the next 5 years, The company requires 15% return on capital investments of this sort and desires a 36 -month pay back period. What is the net present value of this proposal? Enter your answer as a monetary amount rounded to four decimal places, furt without the currency symbot For evomple, If your onnwer is 590.1234, enter 90,1234 . If you answer is less than zero, enter anegative volue, Whe this: 290.1234 store will require fixtures, ete, which will cost $1253251 before the store can begin operating. These wil be depreciated straishtline over 5 years assuminga 75 . salvago value. The salvage amount will also be included as part of the terminal value, representing the amount recaptured at the end of year 5 . There will be no tax effect in the salvage value because the book value is oxpected to be 7% of the historical cost at the end of year 5 . There will be a need for $12722 for net working This amount will be released in the final year as part of the terminal value. Sales for each year are forecasted to be: - Year 1:\$425,312 + Year2:5901,281 - Year 3:51,414,237 - Year 4:52,100,000 - Vear 5:52,100,000 - Cath operating costs will be 65% of rovenue for each year. What is the net present value of this proposa? Enter your onswer as a monetary amount rounded to four decimal places, but without the currency symbol. For example, if your answer is 590,1234 , enter 90.1234 . If you answer is less than zero, enter a negative value, like this: =90.1234 A company wants to replace a machine with a better version. The replacement machine will require a net investrnent of $204.066 and is expected to gonerate free exting m.ichine would continue to function for the next five years if it is not replaced, but gradually become less useful. Free cash flows for the existing machine are. forecasted to be $82,563 in year 1,$63,522 in year 2,$42,864 in year 3,$24,342 in year 4 and $12,626 in year 5 . What is the incremental cash flow for year 3 ? Enter your onswer as a monetary amount rounded to four decimal places, but without the currency symbol. For example, if your answer is 590 , 1234 , enter 90.1234 . If you answer is less than repo, enter a negotive vatue, filis this: 90.1234 Type vour anwine. A manufacturing compary has found that altering their process improves the quality of their product so that they have less waste per ton of raw material used to produce their product. The new process, however, requires more energy and more labor. Training, support and setup for the new process is reouired to make sure results will be consistent. The company believes the benefit will last four years before the product is obsolete in the market. The company has a 12% hurdie rate for projects of this type (i.e, the required rate of return is 12% and requires a 36-month payback period. They are subject to a.25\% tax rate. The initial imestment consists of $100,000, all of which is a period expense (i.e, part of cash operating expenses in Year 0 ). The net savings, including the effect of material consumption, labor, energv, etc. would $35000 per year for years 1-4. This amount would reduce cash operating expenses in the forecast years (creating a porithe effect on operatins incomel. How many months is the pay back period for this proposal? Enter your answer as a number with two decimal places. For example, if your answer is 90.1234 , enter 90.12 Tyoe your answer. A company has a machine which will continue to function for the next five years, but gradually become less productive. Free cash flows for the existing machine are forecasted to be $92,053 in year 1,555,630 in year 2,532,363 in year 3,519,984 in year 4 and 55,018 in year 5 , A salerman is thying to comvince a company to replace this machine with a new model. The replacement machine will require a net imvestment of $158,654 and is expected to generate free cash flow of $85,490 per year for the next 5 years, The company requires 15% return on capital investments of this sort and desires a 36 -month pay back period. What is the net present value of this proposal? Enter your answer as a monetary amount rounded to four decimal places, furt without the currency symbot For evomple, If your onnwer is 590.1234, enter 90,1234 . If you answer is less than zero, enter anegative volue, Whe this: 290.1234 store will require fixtures, ete, which will cost $1253251 before the store can begin operating. These wil be depreciated straishtline over 5 years assuminga 75 . salvago value. The salvage amount will also be included as part of the terminal value, representing the amount recaptured at the end of year 5 . There will be no tax effect in the salvage value because the book value is oxpected to be 7% of the historical cost at the end of year 5 . There will be a need for $12722 for net working This amount will be released in the final year as part of the terminal value. Sales for each year are forecasted to be: - Year 1:\$425,312 + Year2:5901,281 - Year 3:51,414,237 - Year 4:52,100,000 - Vear 5:52,100,000 - Cath operating costs will be 65% of rovenue for each year. What is the net present value of this proposa? Enter your onswer as a monetary amount rounded to four decimal places, but without the currency symbol. For example, if your answer is 590,1234 , enter 90.1234 . If you answer is less than zero, enter a negative value, like this: =90.1234 A company wants to replace a machine with a better version. The replacement machine will require a net investrnent of $204.066 and is expected to gonerate free exting m.ichine would continue to function for the next five years if it is not replaced, but gradually become less useful. Free cash flows for the existing machine are. forecasted to be $82,563 in year 1,$63,522 in year 2,$42,864 in year 3,$24,342 in year 4 and $12,626 in year 5 . What is the incremental cash flow for year 3 ? Enter your onswer as a monetary amount rounded to four decimal places, but without the currency symbol. For example, if your answer is 590 , 1234 , enter 90.1234 . If you answer is less than repo, enter a negotive vatue, filis this: 90.1234 Type vour anwine. A manufacturing compary has found that altering their process improves the quality of their product so that they have less waste per ton of raw material used to produce their product. The new process, however, requires more energy and more labor. Training, support and setup for the new process is reouired to make sure results will be consistent. The company believes the benefit will last four years before the product is obsolete in the market. The company has a 12% hurdie rate for projects of this type (i.e, the required rate of return is 12% and requires a 36-month payback period. They are subject to a.25\% tax rate. The initial imestment consists of $100,000, all of which is a period expense (i.e, part of cash operating expenses in Year 0 ). The net savings, including the effect of material consumption, labor, energv, etc. would $35000 per year for years 1-4. This amount would reduce cash operating expenses in the forecast years (creating a porithe effect on operatins incomel. How many months is the pay back period for this proposal? Enter your answer as a number with two decimal places. For example, if your answer is 90.1234 , enter 90.12 Tyoe your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts