Question: A manufacturing company has found that altering their process improves the quality of their product so that they have less waste per ton of raw

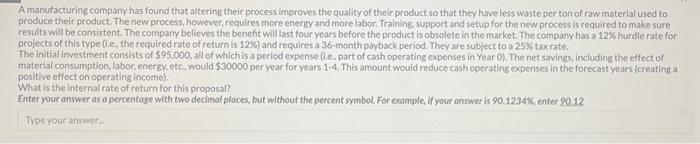

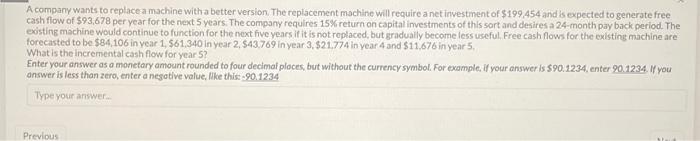

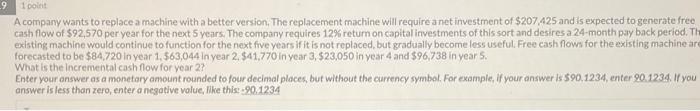

A manufacturing company has found that altering their process improves the quality of their product so that they have less waste per ton of raw material used to produce their product The new process, however, requtres more energy and more labor. Training, support and setup for the new process is required to minke sure results will be consistent. The company befieves the benefit will last fouryears before the product is obsolete in the market. The company has a 12% hurdle rate for projects of this type (ie, the required rate of returnis 12% ) and requires a 36 -month payback period. They are subject to a 25% tax rate. The initial investment consists of $95,000, all of which is a period expense (i.e, part of cash operating expenses in Year 0 ). The net savings, including the effect of material consumption, labor, energy, etc, would $30000 per year for years 1-4. This amount would reduce cash operating expenses in the forecast years (creating of positive effect on operating income). What is the internal rate of return for this proposal? Enter your answer as a percentoge with two decimal places, but without the percent symbol. For example, if your answer is 90.1234%, enter 90,12 A company wants to replace a machine with a better version. The replacement machine will require a net investment of $199,454 and is expected to generate free cash flow of $93,678 per vear for the next 5 vears. The company requires 15%, return on eapital imestments of thls sort and desites a 24 - month pay bnck perfot. The existing mochine would continue to function for the next five years if it is not roplaced, but gradually become less useful. Free cash flows for the existing machine are forecasted to be $84,106 in year 1,$61,340 in year 2,$43,769 in year 3,$21,774 in year 4 and $11,676 in year 5 . What is the incremental cash flow for year 5 ? Enter your answer as a monetary amount rounded to four decimai ploces, but without the currency symbol. For example. if your answer is $90.1234, enter 90.1234 . If you onswer is less than zero, enter a nesothe value, fllke this: -90.1234 A company wants to replace a machine with a better version. The replacement machine will require a net investment of $207,425 and is expected to generate free. cash flow of $92,570 per year for the next 5 years. The company requires 12% return on capital investments of this sort and desires a 24 -month pay back period. Th existing machine would continue to function for the next five years if it is not replaced, but gradually become less useful. Free cash flows for the existing machine ar forecasted to be $84,720 in year 1,$63,044 in year 2,$41,770 in year 3,$23,050 in year 4 and $96,738 in year 5 . What is the incremental cash flow for year 2 ? Enter your answer as a monetary amount rounded to four decimal places, but without the currency symbol. For example, if your answer is $90,1234, enter 90.1234 . If you answer is tess than zero, enter a negative value, fike this: -90.1234 A manufacturing company has found that altering their process improves the quality of their product so that they have less waste per ton of raw material used to produce their product The new process, however, requtres more energy and more labor. Training, support and setup for the new process is required to minke sure results will be consistent. The company befieves the benefit will last fouryears before the product is obsolete in the market. The company has a 12% hurdle rate for projects of this type (ie, the required rate of returnis 12% ) and requires a 36 -month payback period. They are subject to a 25% tax rate. The initial investment consists of $95,000, all of which is a period expense (i.e, part of cash operating expenses in Year 0 ). The net savings, including the effect of material consumption, labor, energy, etc, would $30000 per year for years 1-4. This amount would reduce cash operating expenses in the forecast years (creating of positive effect on operating income). What is the internal rate of return for this proposal? Enter your answer as a percentoge with two decimal places, but without the percent symbol. For example, if your answer is 90.1234%, enter 90,12 A company wants to replace a machine with a better version. The replacement machine will require a net investment of $199,454 and is expected to generate free cash flow of $93,678 per vear for the next 5 vears. The company requires 15%, return on eapital imestments of thls sort and desites a 24 - month pay bnck perfot. The existing mochine would continue to function for the next five years if it is not roplaced, but gradually become less useful. Free cash flows for the existing machine are forecasted to be $84,106 in year 1,$61,340 in year 2,$43,769 in year 3,$21,774 in year 4 and $11,676 in year 5 . What is the incremental cash flow for year 5 ? Enter your answer as a monetary amount rounded to four decimai ploces, but without the currency symbol. For example. if your answer is $90.1234, enter 90.1234 . If you onswer is less than zero, enter a nesothe value, fllke this: -90.1234 A company wants to replace a machine with a better version. The replacement machine will require a net investment of $207,425 and is expected to generate free. cash flow of $92,570 per year for the next 5 years. The company requires 12% return on capital investments of this sort and desires a 24 -month pay back period. Th existing machine would continue to function for the next five years if it is not replaced, but gradually become less useful. Free cash flows for the existing machine ar forecasted to be $84,720 in year 1,$63,044 in year 2,$41,770 in year 3,$23,050 in year 4 and $96,738 in year 5 . What is the incremental cash flow for year 2 ? Enter your answer as a monetary amount rounded to four decimal places, but without the currency symbol. For example, if your answer is $90,1234, enter 90.1234 . If you answer is tess than zero, enter a negative value, fike this: -90.1234

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts