Question: A company has to decide whether to select a project or not. The following information are provided: The cost of the capital expenditure involved is

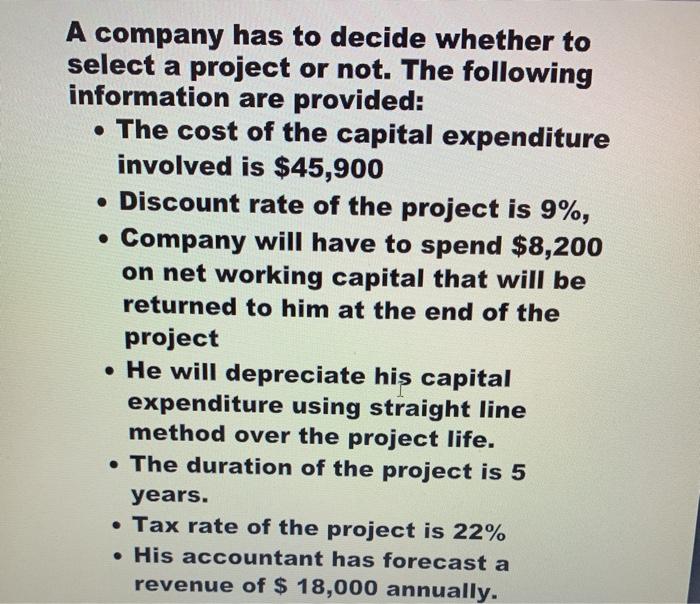

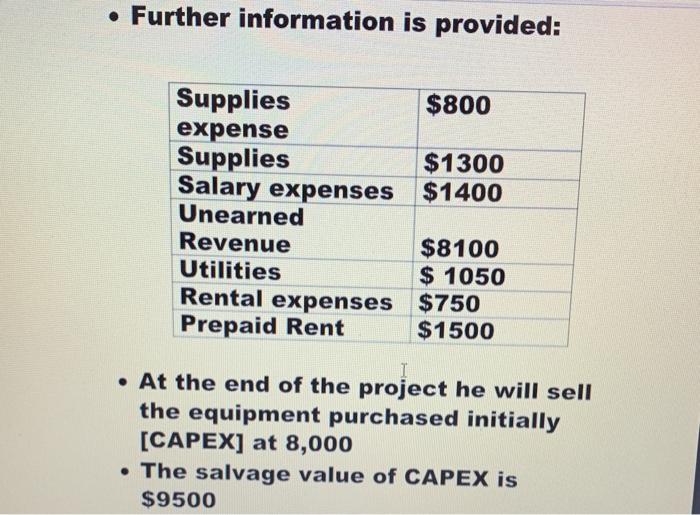

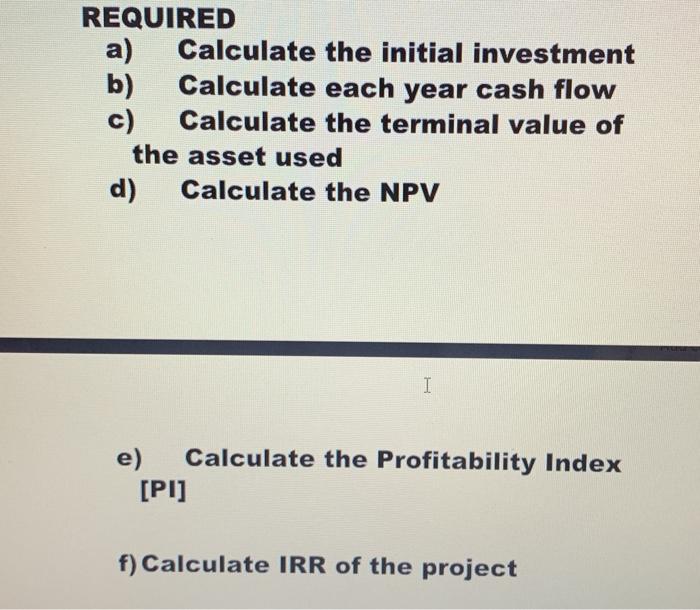

A company has to decide whether to select a project or not. The following information are provided: The cost of the capital expenditure involved is $45,900 Discount rate of the project is 9%, Company will have to spend $8,200 on net working capital that will be returned to him at the end of the project He will depreciate his capital expenditure using straight line method over the project life. The duration of the project is 5 years. Tax rate of the project is 22% His accountant has forecast a revenue of $ 18,000 annually. Further information is provided: Supplies $800 expense Supplies $1300 Salary expenses $1400 Unearned Revenue $8100 Utilities $ 1050 Rental expenses $750 Prepaid Rent $1500 At the end of the project he will sell the equipment purchased initially [CAPEX] at 8,000 The salvage value of CAPEX is $9500 REQUIRED a) Calculate the initial investment b) Calculate each year cash flow c) Calculate the terminal value of the asset used d) Calculate the NPV I e) Calculate the Profitability Index [PI] f) Calculate IRR of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts