Question: Estimate the dollar increase in DPC's value if a PE firm can implement the following policy changes: a. 5% revenue growth per annum (versus 4%

a. 5% revenue growth per annum (versus 4% growth) in each of the next 5 years and improvement in operating margins to 12% (versus 10%)

b. In addition to a., assume that the division can be sold at 7.5x EBITDA in 5 years

c. In addition to a. and b., assume debt financing equal to 6x forward EBITDA can be obtained. Assume all cash available each year is used to pay down the LBO debt. In 5 years, the firm will become an all-equity firm.

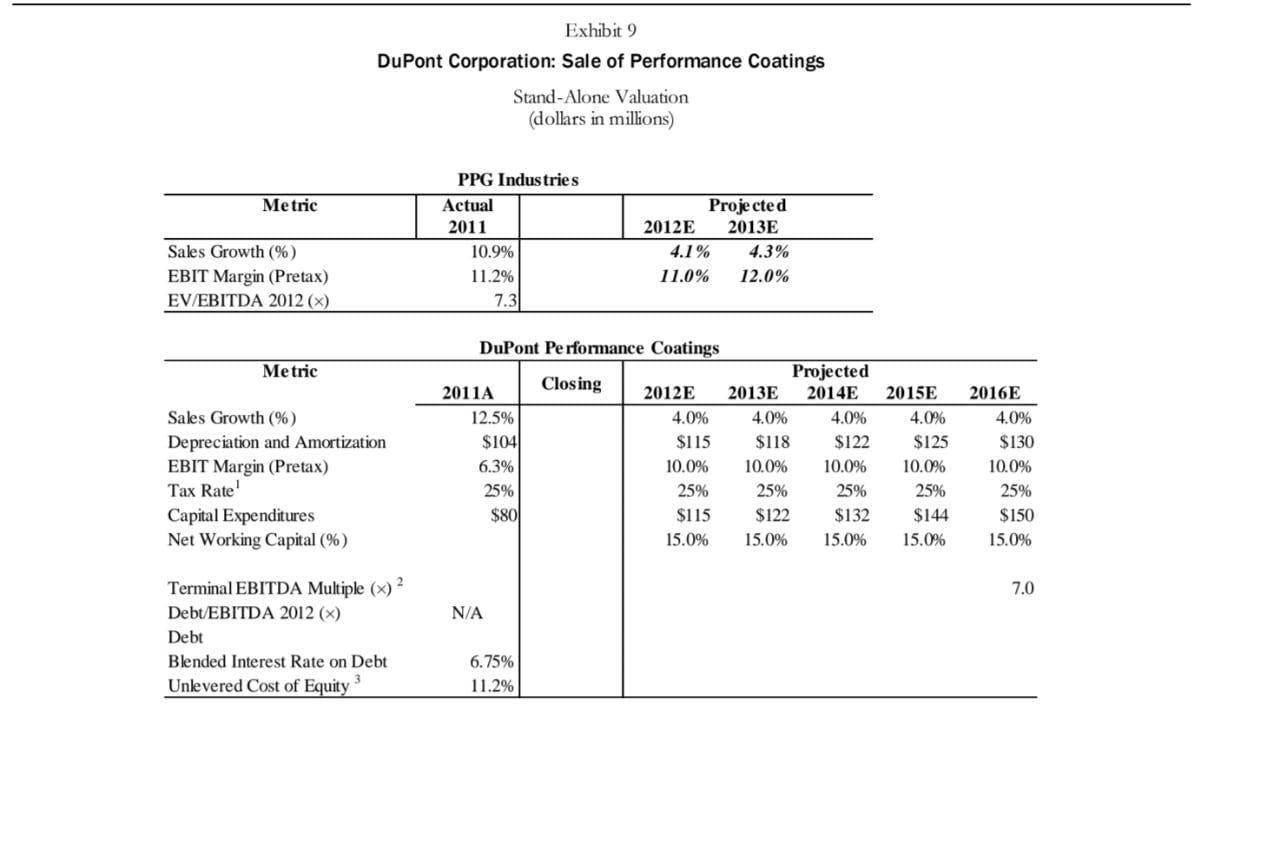

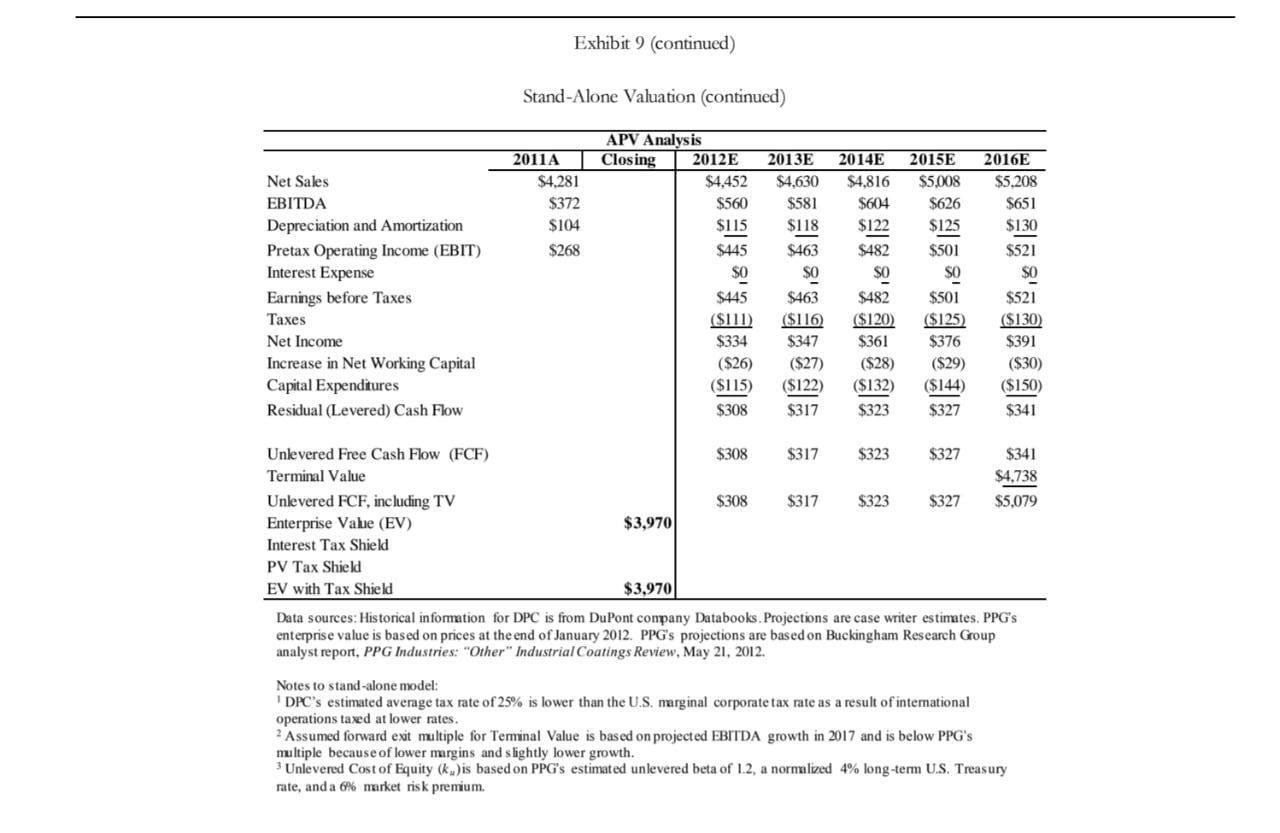

Exhibit 9 DuPont Corporation: Sale of Performance Coatings Stand-Alone Valuation (dollars in millions) PPG Industries Metric Actual 2011 Sales Growth (%) EBIT Margin (Pretax) EV/EBITDA 2012 (x) 10.9% 11.2% 7.3 2012E Projected 2013E 4.1% 4.3% 11.0% 12.0% DuPont Performance Coatings Metric Sales Growth (%) Projected 2011A Closing 2012E 2013E 2014E 2015E 2016E 12.5% 4.0% 4.0% 4.0% 4.0% 4.0% Depreciation and Amortization $104 $115 $118 $122 $125 $130 EBIT Margin (Pretax) 6.3% 10.0% 10.0% 10.0% 10.0% 10.0% Tax Rate' 25% 25% 25% 25% 25% 25% Capital Expenditures $80 $115 $122 $132 $144 $150 Net Working Capital (%) 15.0% 15.0% 15.0% 15.0% 15.0% Terminal EBITDA Multiple (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts