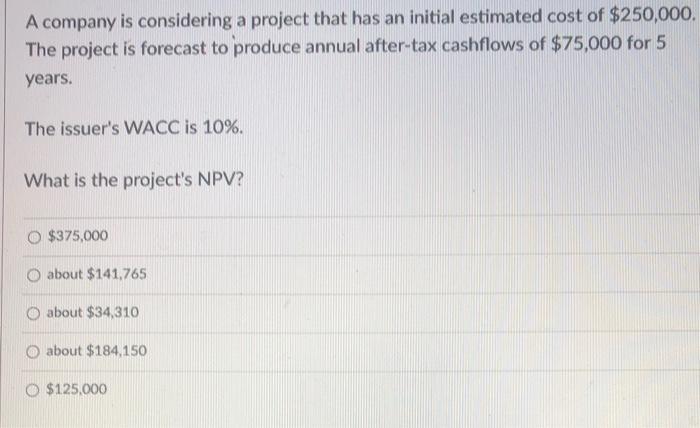

Question: A company is considering a project that has an initial estimated cost of $250,000, The project is forecast to produce annual after-tax cashflows of $75,000

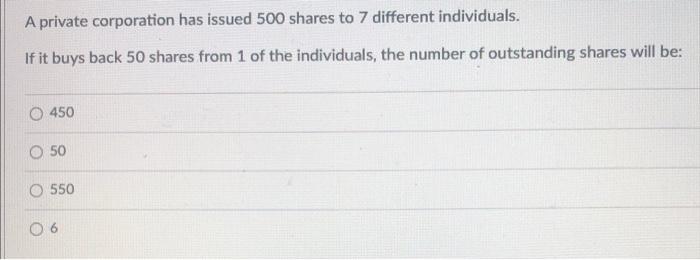

A company is considering a project that has an initial estimated cost of $250,000, The project is forecast to produce annual after-tax cashflows of $75,000 for 5 years. The issuer's WACC is 10%. What is the project's NPV? $375,000 O about $141,765 O about $34,310 O about $184,150 O $125,000 A private corporation has issued 500 shares to 7 different individuals. If it buys back 50 shares from 1 of the individuals, the number of outstanding shares will be: 450 50 550 O 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts