Question: A company is considering a project that has an initial estimated cost of $90,000. The project is forecast to produce annual after-tax cashflows of $40,000

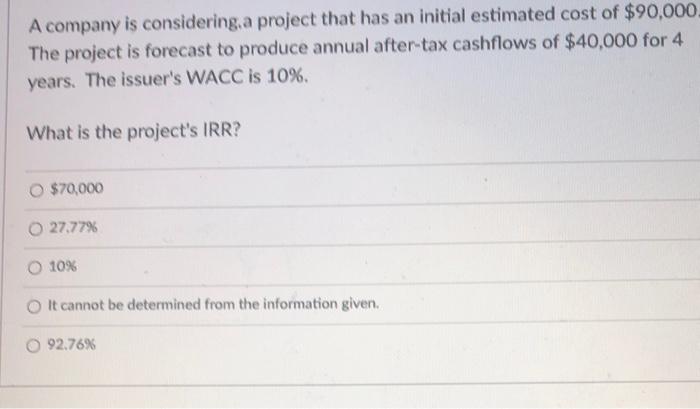

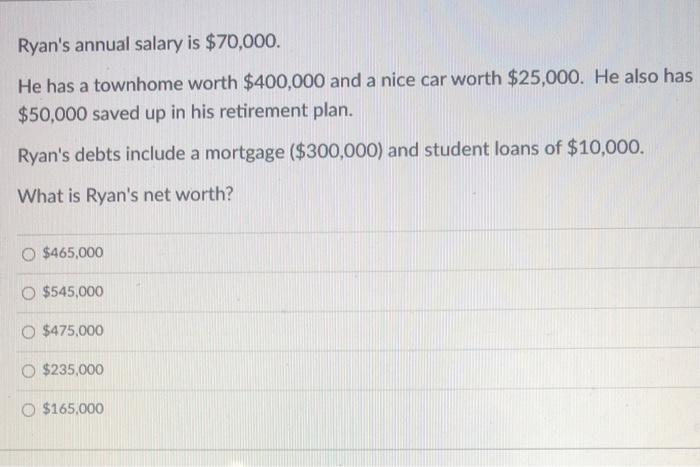

A company is considering a project that has an initial estimated cost of $90,000. The project is forecast to produce annual after-tax cashflows of $40,000 for 4 years. The issuer's WACC is 10%. What is the project's IRR? $70,000 O 27.77% 10% It cannot be determined from the information given. 92.76% Ryan's annual salary is $70,000. a He has a townhome worth $400,000 and a nice car worth $25,000. He also has $50,000 saved up in his retirement plan. Ryan's debts include a mortgage ($300,000) and student loans of $10,000. What is Ryan's net worth? $465,000 O $545,000 O $475,000 $235,000 $165.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts