Question: A company is considering three different projects (A, B, C) in an attempt to diversify. The effectiveness of each project (in terms of revenue)

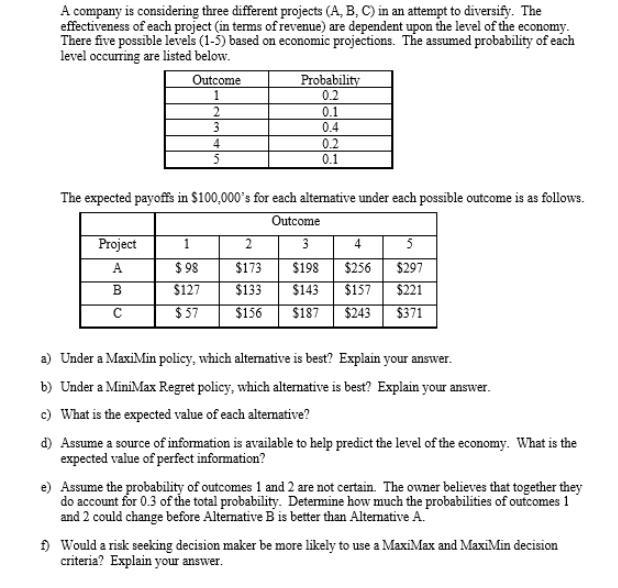

A company is considering three different projects (A, B, C) in an attempt to diversify. The effectiveness of each project (in terms of revenue) are dependent upon the level of the economy. There five possible levels (1-5) based on economic projections. The assumed probability of each level occurring are listed below. Probability 0.2 Outcome 1 2 0.1 3 0.4 4 0.2 5 0.1 The expected payoffs in $100,000's for each alternative under each possible outcome is as follows. Outcome Project 1 2 3 4 5 A $98 $173 $198 $256 $297 B $127 $133 $143 $157 $221 C $57 $156 $187 $243 $371 a) Under a MaxiMin policy, which alternative is best? Explain your answer. b) Under a MiniMax Regret policy, which alternative is best? Explain your answer. c) What is the expected value of each alternative? d) Assume a source of information is available to help predict the level of the economy. What is the expected value of perfect information? e) Assume the probability of outcomes 1 and 2 are not certain. The owner believes that together they do account for 0.3 of the total probability. Determine how much the probabilities of outcomes 1 and 2 could change before Alternative B is better than Alternative A. f) Would a risk seeking decision maker be more likely to use a MaxiMax and MaxiMin decision criteria? Explain your answer.

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

a Under the MaxiMin policy the best of the worst strategy will be selected Minimum possible return will be selected for each alternative and the decis... View full answer

Get step-by-step solutions from verified subject matter experts