Question: A company is considering two mutually exclusive projects requiring an initial cash outlay of Sh 10,000 each and with a useful life of 5 years.

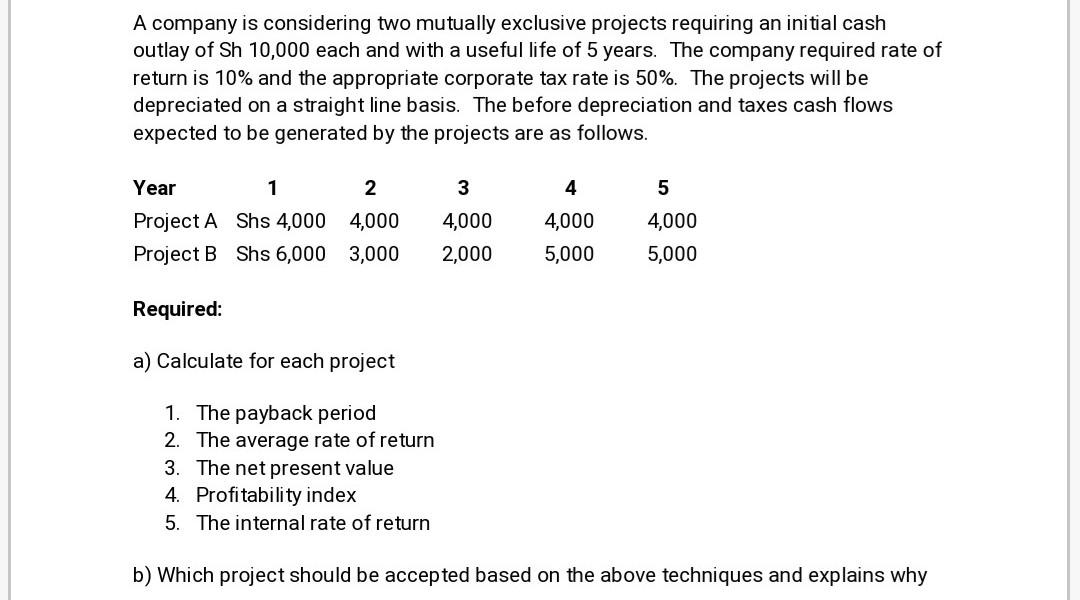

A company is considering two mutually exclusive projects requiring an initial cash outlay of Sh 10,000 each and with a useful life of 5 years. The company required rate of return is 10% and the appropriate corporate tax rate is 50%. The projects will be depreciated on a straight line basis. The before depreciation and taxes cash flows expected to be generated by the projects are as follows. Year 1 2 3 4 5 Project A Shs 4,000 4,000 Project B Shs 6,000 3,000 4,000 2,000 4,000 5,000 4,000 5,000 Required: a) Calculate for each project 1. The payback period 2. The average rate of return 3. The net present value 4. Profitability index 5. The internal rate of return b) Which project should be accepted based on the above techniques and explains why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts