Question: Help answer All questions A company is considering two mutually exclusive projects requiring an initial cash outlay of Sh 10,000 each and with a useful

Help answer All questions

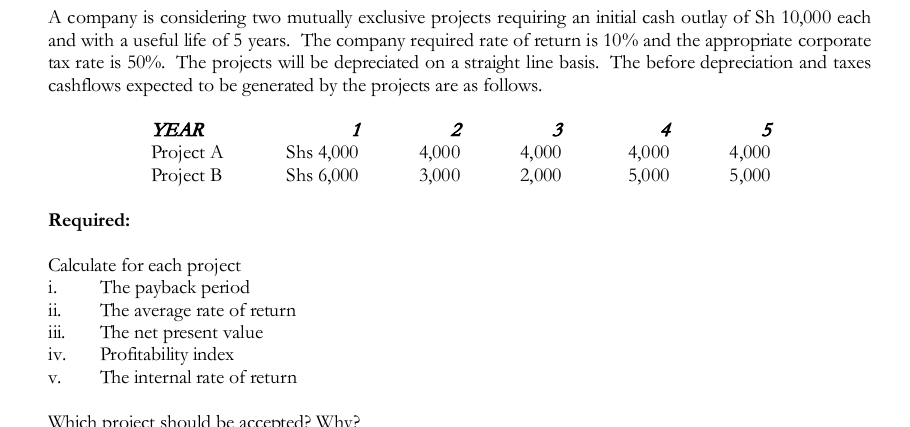

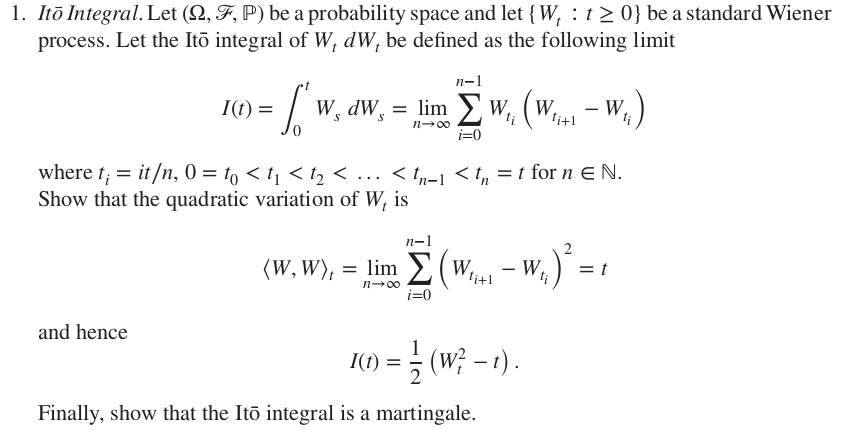

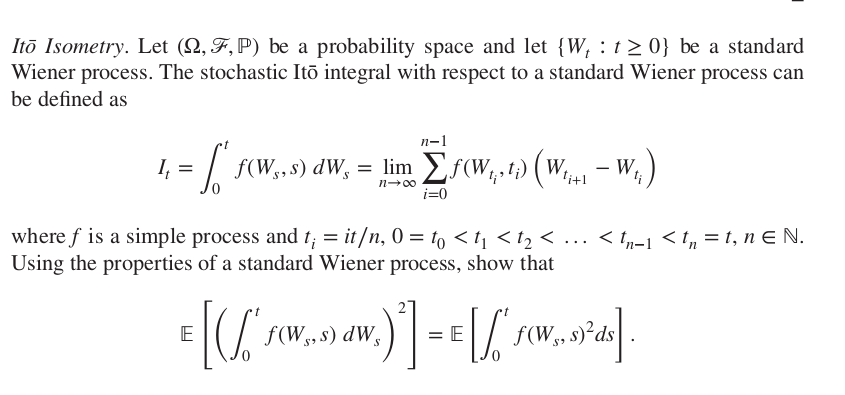

A company is considering two mutually exclusive projects requiring an initial cash outlay of Sh 10,000 each and with a useful life of 5 years. The company required rate of return is 10% and the appropriate corporate tax rate is 50%. The projects will be depreciated on a straight line basis. The before depreciation and taxes cashflows expected to be generated by the projects are as follows. YEAR 2 3 4 5 Project A Shs 4,000 4.000 4,000 4,000 4,000 Project B Shs 6,000 3,000 2,000 5,000 5,000 Required: Calculate for each project The payback period 11. The average rate of return ili. The net present value iv . Profitability index V. The internal rate of return Which proie d be accepted? Why?1. Ito Integral. Let (2, #, P) be a probability space and let { W, : t 2 0} be a standard Wiener process. Let the Ito integral of W, dW, be defined as the following limit Mi I(1) = W. dW = lim Wti W - W 11=00 tit l 1=0 where t; = it, 0 = to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts