Question: A company is trying to decide whether it should accept or reject a new 3-year project. If accepted, the project requires an immediate investment into

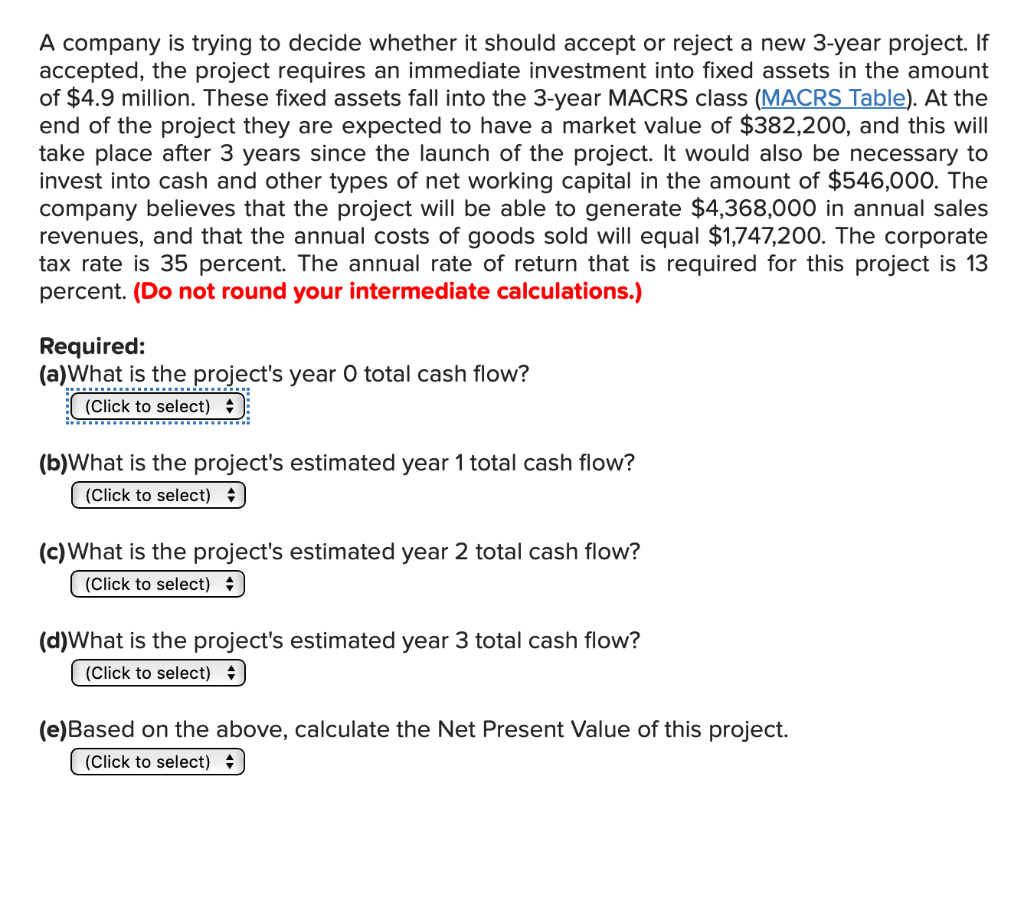

A company is trying to decide whether it should accept or reject a new 3-year project. If accepted, the project requires an immediate investment into fixed assets in the amount of $4.9 million. These fixed assets fall into the 3-year MACRS class (MACRS Table). At the end of the project they are expected to have a market value of $382,200, and this will take place after 3 years since the launch of the project. It would also be necessary to invest into cash and other types of net working capital in the amount of $546,000. The company believes that the project will be able to generate $4,368,000 in annual sales revenues, and that the annual costs of goods sold will equal $1,747,200. The corporate tax rate is 35 percent. The annual rate of return that is required for this project is 13 percent. (Do not round your intermediate calculations.) Required: (a)What is the project's year 0 total cash flow? (Click to select) (b)What the project's estimated year 1 total cash flow? (Click to select) - (c) What is the project's estimated year 2 total cash flow? (Click to select) (d)What is the project's estimated year 3 total cash flow? (Click to select) (e)Based on the above, calculate the Net Present Value of this project. (Click to select)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts