Question: A company is trying to decide whether it should accept or reject a new 3-year project. If accepted, the project requires an immediate investment into

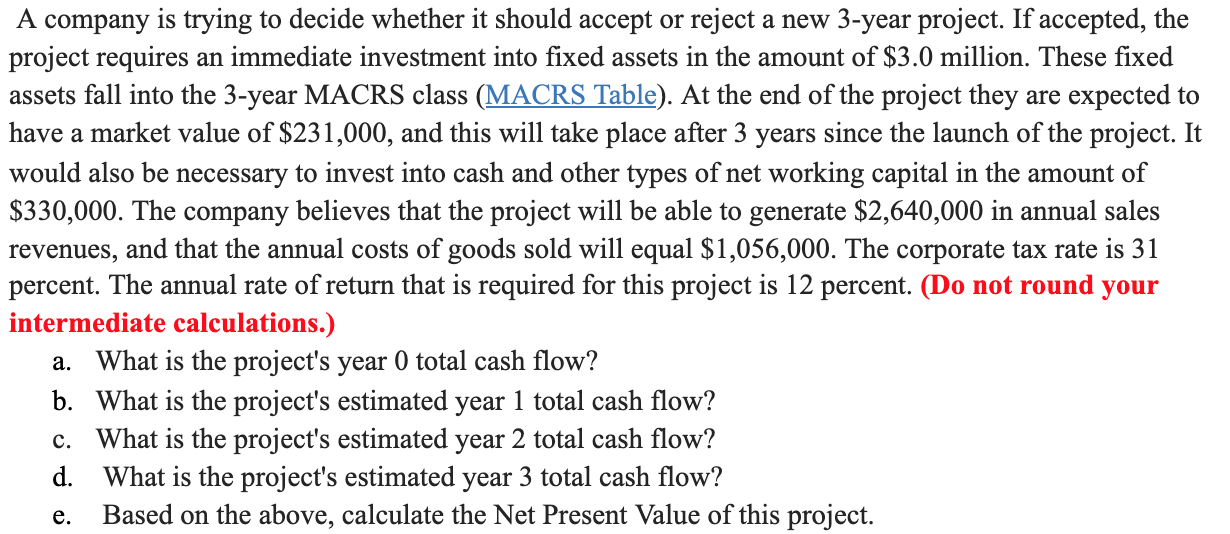

A company is trying to decide whether it should accept or reject a new 3-year project. If accepted, the project requires an immediate investment into fixed assets in the amount of $3.0 million. These fixed assets fall into the 3-year MACRS class (MACRS Table). At the end of the project they are expected to have a market value of $231,000, and this will take place after 3 years since the launch of the project. It would also be necessary to invest into cash and other types of net working capital in the amount of $330,000. The company believes that the project will be able to generate $2,640,000 in annual sales revenues, and that the annual costs of goods sold will equal $1,056,000. The corporate tax rate is 31 percent. The annual rate of return that is required for this project is 12 percent. (Do not round your intermediate calculations.) a. What is the project's year 0 total cash flow? b. What is the project's estimated year 1 total cash flow? c. What is the project's estimated year 2 total cash flow? d. What is the project's estimated year 3 total cash flow? Based on the above, calculate the Net Present Value of this project. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts