Question: A company needs a modern material handling system for facilitating access to and from a busy warehouse. If the companys management use a MARR (given

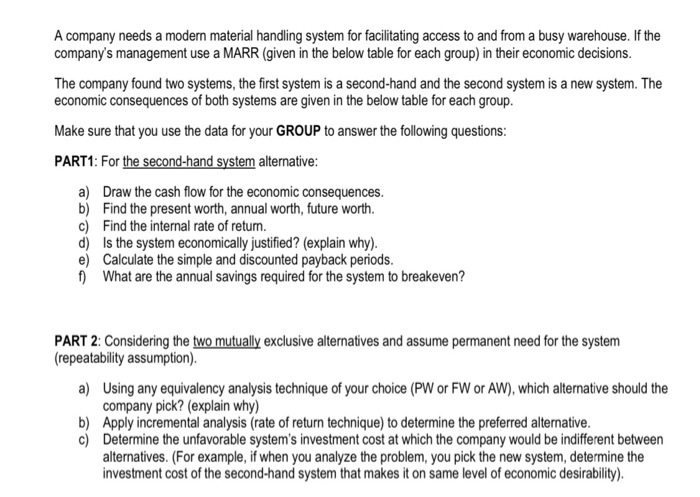

A company needs a modern material handling system for facilitating access to and from a busy warehouse. If the companys management use a MARR (given in the below table for each group) in their economic decisions.

The company found two systems, the first system is a second-hand and the second system is a new system. The economic consequences of both systems are given in the below table for each group. Answer the following questions:

MARR= 22.5% per year

For Second-Hand system:

Investment Cost= $146,600

Annual expenses=$17,300

Annual savings= $61,000

Useful Life = 7 years

Salvage Value = $43,000

For New system:

Investment cost =$199,500

Annual expenses=$34200

First year savings=$98,400 decreasing by 4% each year thereafter

Useful life=14 years

Salvage value=$51,000

PART1: For the second-hand system alternative:

a) Draw the cash flow for the economic consequences.

b) Find the present worth, annual worth, future worth.

c) Find the internal rate of return.

d) Is the system economically justified? (explain why).

e) Calculate the simple and discounted payback periods.

f) What are the annual savings required for the system to breakeven?

PART 2: Considering the two mutually exclusive alternatives and assume permanent need for the system (repeatability assumption).

a) Using any equivalency analysis technique of your choice (PW or FW or AW), which alternative should the company pick? (explain why)

b) Apply incremental analysis (rate of return technique) to determine the preferred alternative.

c) Determine the unfavorable systems investment cost at which the company would be indifferent between

alternatives. (For example, if when you analyze the problem, you pick the new system, determine the investment cost of the second-hand system that makes it on same level of economic desirability).

A company needs a modern material handling system for facilitating access to and from a busy warehouse. If the company's management use a MARR (given in the below table for each group) in their economic decisions. The company found two systems, the first system is a second-hand and the second system is a new system. The economic consequences of both systems are given in the below table for each group. Make sure that you use the data for your GROUP to answer the following questions: PART1: For the second-hand system alternative: a) Draw the cash flow for the economic consequences. b) Find the present worth, annual worth, future worth. c) Find the internal rate of return. d) Is the system economically justified? (explain why). e) Calculate the simple and discounted payback periods. ) What are the annual savings required for the system to breakeven? PART 2: Considering the two mutually exclusive alternatives and assume permanent need for the system (repeatability assumption). a) Using any equivalency analysis technique of your choice (PW or FW or AW), which alternative should the company pick? (explain why) b) Apply incremental analysis (rate of return technique) to determine the preferred alternative. c) Determine the unfavorable system's investment cost at which the company would be indifferent between alternatives. (For example, if when you analyze the problem, you pick the new system, determine the investment cost of the second-hand system that makes it on same level of economic desirability)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts