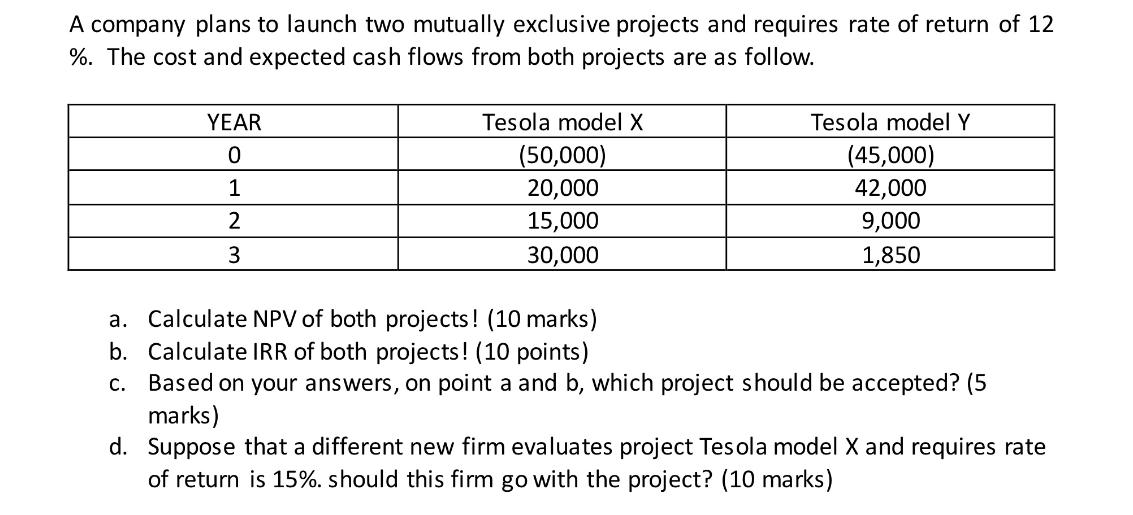

Question: A company plans to launch two mutually exclusive projects and requires rate of return of 12 %. The cost and expected cash flows from

A company plans to launch two mutually exclusive projects and requires rate of return of 12 %. The cost and expected cash flows from both projects are as follow. YEAR 0 1 2 3 Tesola model X (50,000) 20,000 15,000 30,000 Tesola model Y (45,000) 42,000 9,000 1,850 a. Calculate NPV of both projects! (10 marks) b. Calculate IRR of both projects! (10 points) C. Based on your answers, on point a and b, which project should be accepted? (5 marks) d. Suppose that a different new firm evaluates project Tesola model X and requires rate of return is 15%. should this firm go with the project? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

a Calculate the NPV of both projects Tesola model X Year 0 50000 Year 1 20000 Year 2 15000 Year 3 30... View full answer

Get step-by-step solutions from verified subject matter experts