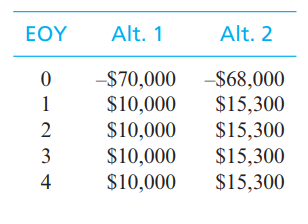

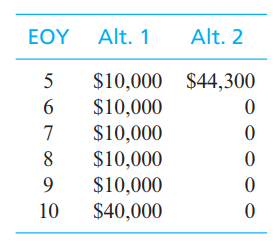

Question: A companys MARR is 10% per year. Two mutually exclusive alternatives are being considered. Compare the two alternatives utilizing: a. The repeatability assumption with a

A companys MARR is 10% per year. Two mutually exclusive alternatives are being considered. Compare the two alternatives utilizing:

a. The repeatability assumption with a 10-year study period.

b. A five-year study period (MV5 of Alt. 1 is $45,000).

\begin{tabular}{crr} \hline EOY & \multicolumn{1}{c}{ Alt. 1 } & \multicolumn{1}{c}{ Alt. 2 } \\ \hline 0 & $70,000 & $68,000 \\ 1 & $10,000 & $15,300 \\ 2 & $10,000 & $15,300 \\ 3 & $10,000 & $15,300 \\ 4 & $10,000 & $15,300 \end{tabular} \begin{tabular}{ccr} \hline EOY & Alt. 1 & \multicolumn{1}{c}{ Alt. 2 } \\ \hline 5 & $10,000 & $44,300 \\ 6 & $10,000 & 0 \\ 7 & $10,000 & 0 \\ 8 & $10,000 & 0 \\ 9 & $10,000 & 0 \\ 10 & $40,000 & 0 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts