Question: A company's MArR is 10% per year. Two mutually exclusive alternatives are being considered Compare the two alternatives utilizing a. The repeatability assumption with a

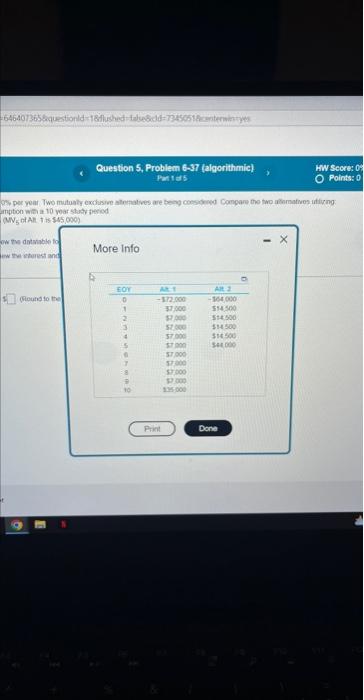

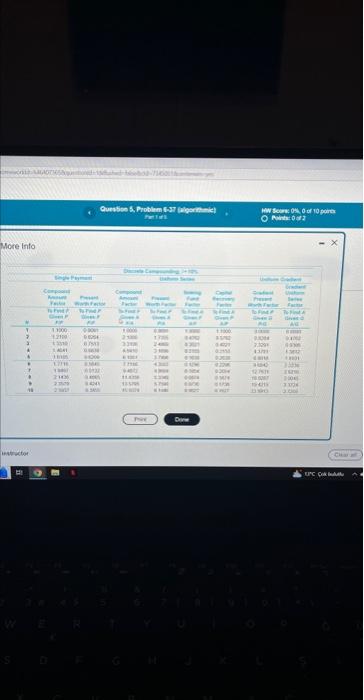

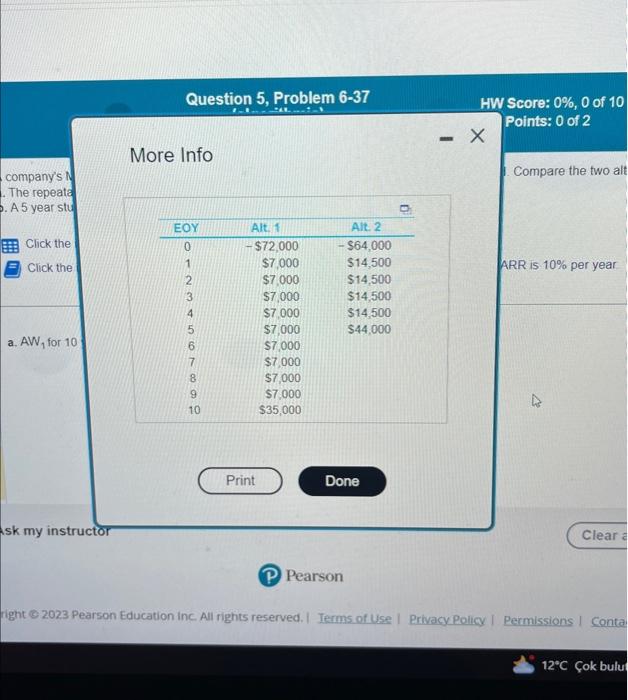

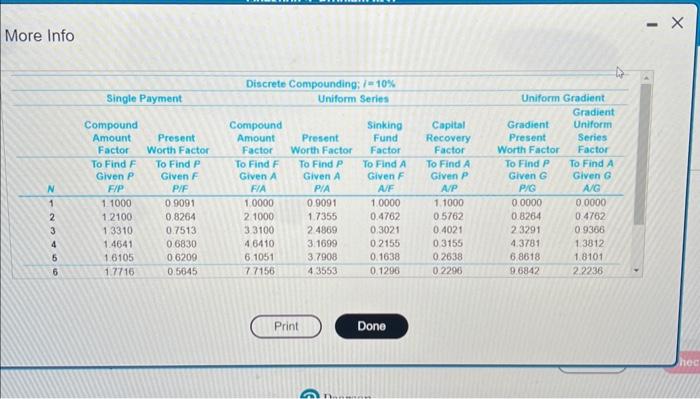

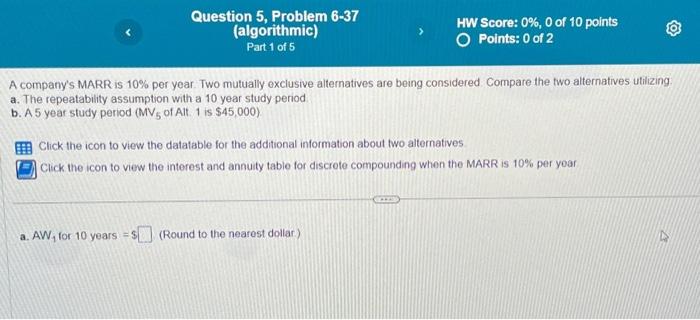

A company's MArR is 10% per year. Two mutually exclusive alternatives are being considered Compare the two alternatives utilizing a. The repeatability assumption with a 10 year study period b. A 5 year study period ( MV5 of Alt. 1 is $45,000 ) Click the icon to view the datatable for the additional information about two alternatives Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year a. AW1 for 10 years =$ (Round to the nearest dollar.) mption with a 10 voar shuty inerod aN5 of All t tis 545000} More info More into x More Info Compare the two alt More Info A company's MARR is 10% per year. Two mutually exclusive alternatives are being considered Compare the two alternatives utilizing a. The repeatability assumption with a 10 year study period b. A 5 year study period (MV5 of Alt. 1 is $45,000) Click the icon to view the datatable for the additional information about two alternatives Click the icon to view the interest and annuity table for discrote compounding when the MARR is 10% per yoar a. AW1 for 10 years = (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts