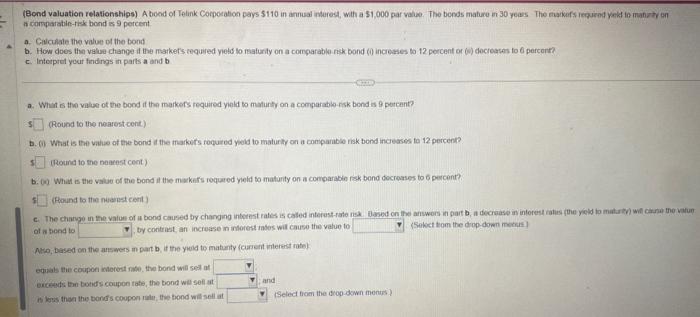

Question: a comparation-isk bond ( mathrm{s} 9 ) percent a. Gilculale the value of the bond b. How does the value change if the market's requied

a comparation-isk bond \\( \\mathrm{s} 9 \\) percent a. Gilculale the value of the bond b. How does the value change if the market's requied yeld lo maturity on a comparable ink bond \\( (0 \\) increases to 12 percent or \\( (0) \\) docreases fo 6 percent? c. Intorpiet your findings in parts a and b a. What is the vilue of the bood it the markers required yold to maturty on a comparabie risk bond is 9 porcent? (Round to the nearest cent) b. (i) What is the vaius of the bond at the markirs roquired yold to maturity on a compambie risk bond incearses fa 12 percent? (Round to the nearest cent) b. (0) What is the value of the bond it the makifs required yeid to maturity on a comparabin rek bend docroases to 6 percant? (Hound to the nuarst cent) of a bend to by contrast, an incresse in intorest rates wil cause the value to (Seloct tom the drop down mokisi) Nio, based on the answers in part b, if the yould to maturity (current interest rate) equals the corpon matosed nabe, the bond will sell at exceets tan botids coupon rate, the bond well self at and is kes then the bond's coopon rulu, the bond wale sell at iselect tioen the drop-down menes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts