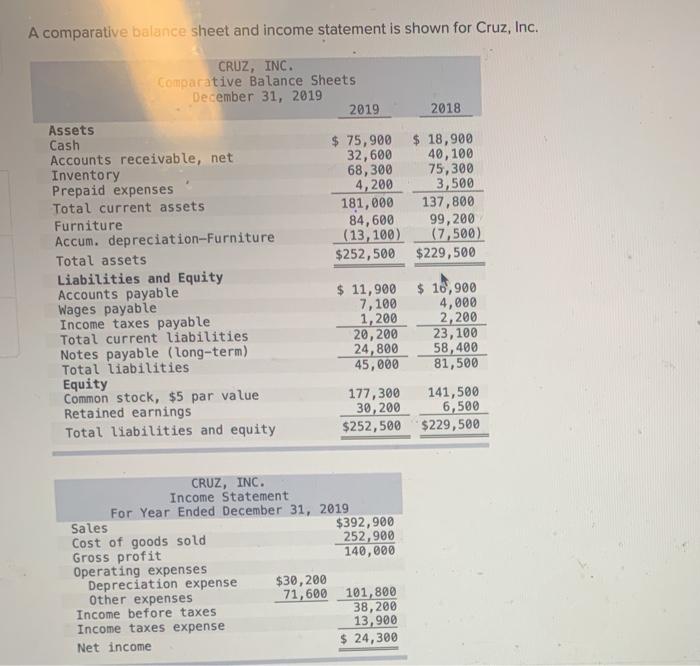

Question: A comparative balance sheet and income statement is shown for Cruz, Inc. 2018 CRUZ, INC. Comparative Balance Sheets December 31, 2019 2019 Assets Cash $

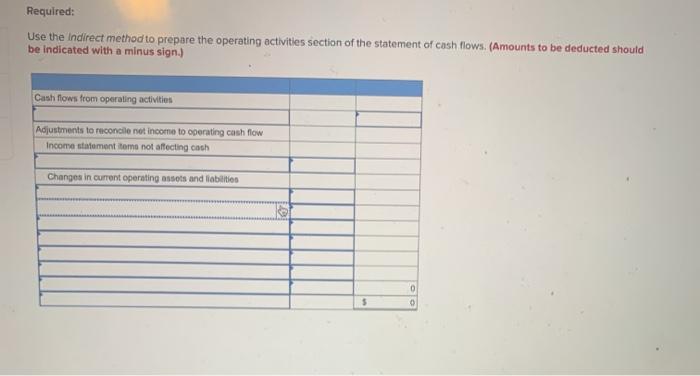

A comparative balance sheet and income statement is shown for Cruz, Inc. 2018 CRUZ, INC. Comparative Balance Sheets December 31, 2019 2019 Assets Cash $ 75,900 Accounts receivable, net 32,600 Inventory 68,300 Prepaid expenses 4,200 Total current assets 181,000 Furniture 84,600 Accum. depreciation-Furniture (13, 100) Total assets $252,500 Liabilities and Equity Accounts payable $ 11,900 Wages payable 7,100 Income taxes payable 1,200 Total current liabilities 20,200 Notes payable (long-term) 24,800 Total liabilities 45,000 Equity Common stock, $5 par value 177,300 Retained earnings 30,200 Total liabilities and equity $252,500 $ 18,900 40,100 75,300 3,500 137,800 99,200 (7,500) $229,500 $ 16,900 4,000 2,200 23,100 58,400 81,500 141,500 6,500 $229,500 CRUZ, INC. Income Statement For Year Ended December 31, 2019 Sales $392,900 Cost of goods sold 252,900 Gross profit 140,000 Operating expenses Depreciation expense $30,200 Other expenses 71,600 101,800 Income before taxes 38,200 Income taxes expense 13,900 Net income $ 24,300 Required: Use the Indirect method to prepare the operating activities section of the statement of cash flows. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from operating activities Adjustments to reconcile not income to operating cash flow Income statement tome not affecting cash Changes in current operating assets and liabilities 0 0 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts