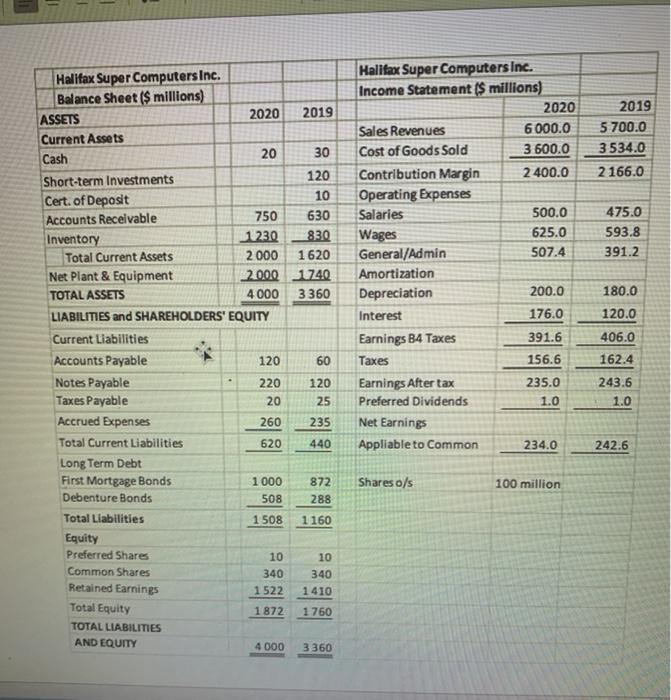

Question: a) Complete the 2020 Cash Flow Statement for Halifax Super Computer b) Complete the 2020 Cash Flow Identity Statement for Halifax Super Computers. cast 201

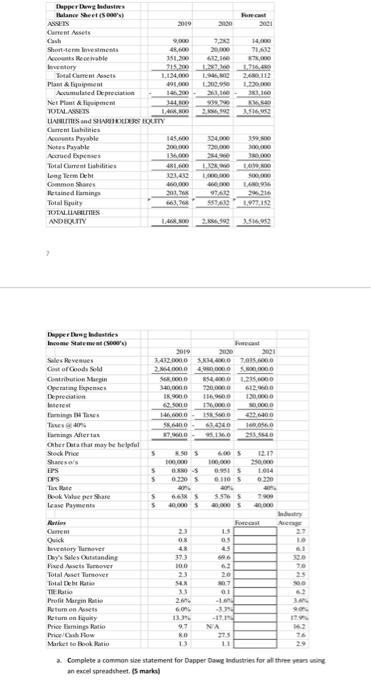

cast 201 6220 14. 7,40 7.000 17 2.60112 1.220.00 LE 2.950 Theppurwg Industries Ilance Sheet() 2019 Current Assets Cash Short-term Investments 47,600 A Rechable 151,200 very 715 Total Current Act 1,134 Planta pent 191.00 Accumulated Depreciation Net we 14 TOTALASSETS 1,400,00 LAST in SOLITY Cunnilishini Act Payable Notas Payable 300,000 Accued pemes 1.00 Total Charroni tiabilities 4100 Long Term Delt 14 Common Shares 40,000 Retained lamin 2017 Totality 3 TOTALABRITIES AND HOLY 14.NO 20 ASSO 15169 NO 304,000 720,000 24.90 LU 1600 wewe SA $89.40 SO 1,022:52 22 Dupperwgladestres Income Statement (0) Sales Huwees Cost or Goods Sold Contribution Mari Operating Expenci Depreciation Interest bring the Thes Toming Alerts Other Data that may be helpful Stock Price Sana's FPS DPS Tax Rate Book Vale per Share lewe het 2019 2100 22. SKO OSLO 2.000.000 S8600 52.000 25.600D 140,000 7200000 622.000 19000 114,00 120.000 6000 12.000 HD 15 42.600 SD 61040 700 SIMO 5 5 5 IS 0.110 12.11 250 1014 0330 5 020 an 665 40005 5 5 5565 23 OX 48 373 15 05 45 06 10 Carre Quick very unever Day Sales anding Fixed Autover Total Asset Tower Total Debt TIEI Profit Marpin Ratin Putum on Assets Hetum eniquity Price timings Ratio Price How Market 01 2014 son 13 97 RO 13 . -11 NA 1 11 a. Complete a common size statement for Dapper Dawg Industries for all three years an excel spreadsheet S marks b. Use the Dupont ratio to calculate the ROE and which ratio should the firm try to improve? ( Show your work! 4 marks) c. Using the ratios template for the forecast, complete the ratios (1 mark each) (show your work). Do you observe any weakness or concerns in the firm's forecast (2 marks)? (9 marks) 2019 5 700.0 3534.0 2 166.0 Halifax Super Computers Inc. Income Statement ($ millions) 2020 Sales Revenues 6000.0 Cost of Goods Sold 3 600.0 Contribution Margin 2 400.0 Operating Expenses Salaries 500.0 Wages 625.0 General/Admin 507.4 Amortization Depreciation 200.0 Interest 176.0 Earnings B4 Taxes 391.6 Taxes 156.6 Earnings After tax 235.0 Preferred Dividends 1.0 Net Earnings Appliable to Common 234.0 475.0 593.8 391.2 Halifax Super Computers Inc. Balance Sheet ($ millions) 2020 2019 ASSETS Current Assets Cash 20 30 120 Short-term Investments Cert. of Deposit 10 Accounts Receivable 750 630 Inventory 1230 830 Total Current Assets 2000 1620 Net Plant & Equipment 2000 1740 TOTAL ASSETS 4000 3360 LIABILITIES and SHAREHOLDERS' EQUITY Current Liabilities Accounts Payable 120 60 Notes Payable 220 120 Taxes Payable 20 25 Accrued Expenses 260 235 Total Current Liabilities 620 440 Long Term Debt First Mortgage Bonds 1000 872 Debenture Bonds 508 288 Total Liabilities 1 508 1160 Equity Preferred Shares 10 10 Common Shares 340 340 Retained Earnings 1522 1410 Total Equity 1872 1760 TOTAL LIABILITIES AND EQUITY 4 000 3 360 180.0 120.0 406.0 162.4 243.6 1.0 242.6 Shares o/s 100 million cast 201 6220 14. 7,40 7.000 17 2.60112 1.220.00 LE 2.950 Theppurwg Industries Ilance Sheet() 2019 Current Assets Cash Short-term Investments 47,600 A Rechable 151,200 very 715 Total Current Act 1,134 Planta pent 191.00 Accumulated Depreciation Net we 14 TOTALASSETS 1,400,00 LAST in SOLITY Cunnilishini Act Payable Notas Payable 300,000 Accued pemes 1.00 Total Charroni tiabilities 4100 Long Term Delt 14 Common Shares 40,000 Retained lamin 2017 Totality 3 TOTALABRITIES AND HOLY 14.NO 20 ASSO 15169 NO 304,000 720,000 24.90 LU 1600 wewe SA $89.40 SO 1,022:52 22 Dupperwgladestres Income Statement (0) Sales Huwees Cost or Goods Sold Contribution Mari Operating Expenci Depreciation Interest bring the Thes Toming Alerts Other Data that may be helpful Stock Price Sana's FPS DPS Tax Rate Book Vale per Share lewe het 2019 2100 22. SKO OSLO 2.000.000 S8600 52.000 25.600D 140,000 7200000 622.000 19000 114,00 120.000 6000 12.000 HD 15 42.600 SD 61040 700 SIMO 5 5 5 IS 0.110 12.11 250 1014 0330 5 020 an 665 40005 5 5 5565 23 OX 48 373 15 05 45 06 10 Carre Quick very unever Day Sales anding Fixed Autover Total Asset Tower Total Debt TIEI Profit Marpin Ratin Putum on Assets Hetum eniquity Price timings Ratio Price How Market 01 2014 son 13 97 RO 13 . -11 NA 1 11 a. Complete a common size statement for Dapper Dawg Industries for all three years an excel spreadsheet S marks b. Use the Dupont ratio to calculate the ROE and which ratio should the firm try to improve? ( Show your work! 4 marks) c. Using the ratios template for the forecast, complete the ratios (1 mark each) (show your work). Do you observe any weakness or concerns in the firm's forecast (2 marks)? (9 marks) 2019 5 700.0 3534.0 2 166.0 Halifax Super Computers Inc. Income Statement ($ millions) 2020 Sales Revenues 6000.0 Cost of Goods Sold 3 600.0 Contribution Margin 2 400.0 Operating Expenses Salaries 500.0 Wages 625.0 General/Admin 507.4 Amortization Depreciation 200.0 Interest 176.0 Earnings B4 Taxes 391.6 Taxes 156.6 Earnings After tax 235.0 Preferred Dividends 1.0 Net Earnings Appliable to Common 234.0 475.0 593.8 391.2 Halifax Super Computers Inc. Balance Sheet ($ millions) 2020 2019 ASSETS Current Assets Cash 20 30 120 Short-term Investments Cert. of Deposit 10 Accounts Receivable 750 630 Inventory 1230 830 Total Current Assets 2000 1620 Net Plant & Equipment 2000 1740 TOTAL ASSETS 4000 3360 LIABILITIES and SHAREHOLDERS' EQUITY Current Liabilities Accounts Payable 120 60 Notes Payable 220 120 Taxes Payable 20 25 Accrued Expenses 260 235 Total Current Liabilities 620 440 Long Term Debt First Mortgage Bonds 1000 872 Debenture Bonds 508 288 Total Liabilities 1 508 1160 Equity Preferred Shares 10 10 Common Shares 340 340 Retained Earnings 1522 1410 Total Equity 1872 1760 TOTAL LIABILITIES AND EQUITY 4 000 3 360 180.0 120.0 406.0 162.4 243.6 1.0 242.6 Shares o/s 100 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts