Question: A compnay uses discounted payback period for small value projects and has a cut off period of 4 years. (The company considers any project

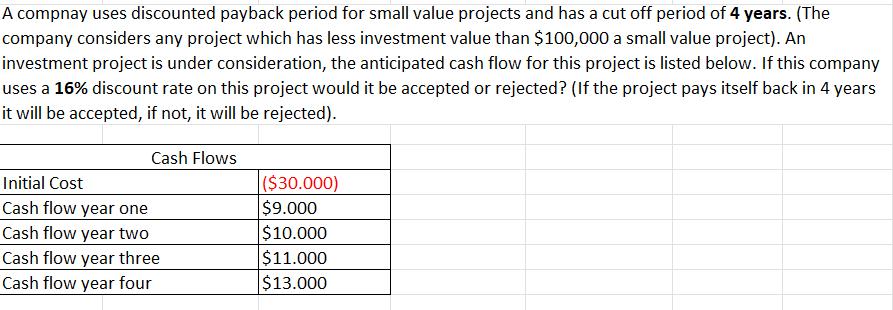

A compnay uses discounted payback period for small value projects and has a cut off period of 4 years. (The company considers any project which has less investment value than $100,000 a small value project). An investment project is under consideration, the anticipated cash flow for this project is listed below. If this company uses a 16% discount rate on this project would it be accepted or rejected? (If the project pays itself back in 4 years it will be accepted, if not, it will be rejected). Cash Flows Initial Cost Cash flow year one Cash flow year two Cash flow year three Cash flow year four ($30.000) $9.000 $10.000 $11.000 $13.000

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Project Evaluation using Discounted Payback Period Given Information Discounted payback period cutof... View full answer

Get step-by-step solutions from verified subject matter experts