Question: a) Compute expected rate of return (% per year), and standard deviation of Bobs portfolio. b) Mr. Belcher says he cannot tolerate any more standard

a) Compute expected rate of return (% per year), and standard deviation of Bobs portfolio. b) Mr. Belcher says he cannot tolerate any more standard deviation than her portfolio has now. Given this risk tolerance, is he maximizing her expected return? If he is, explain why? If he is not, explain how she should invest to maximize expected return (give a specific trading and investment strategy). Note: Show your work.

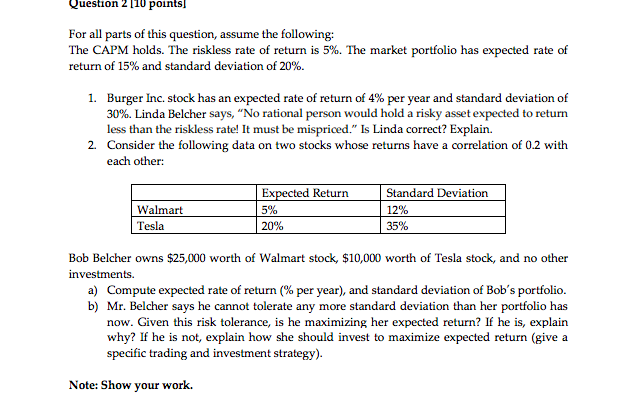

Question 2 [10 points) For all parts of this question, assume the following: The CAPM holds. The riskless rate of return is 5%. The market portfolio has expected rate of return of 15% and standard deviation of 20%. 1. Burger Inc. stock has an expected rate of return of 4% per year and standard deviation of 30%. Linda Belcher says, "No rational person would hold a risky asset expected to return less than the riskless rate! It must be mispriced." Is Linda correct? Explain. 2. Consider the following data on two stocks whose returns have a correlation of 0.2 with each other: Walmart Tesla Expected Return 5% 20% Standard Deviation 12% 35% Bob Belcher owns $25,000 worth of Walmart stock, $10,000 worth of Tesla stock, and no other investments. a) Compute expected rate of return % per year), and standard deviation of Bob's portfolio. b) Mr. Belcher says he cannot tolerate any more standard deviation than her portfolio has now. Given this risk tolerance, is he maximizing her expected return? If he is, explain why? If he is not explain how she should invest to maximize expected return (give a specific trading and investment strategy). Note: Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts