Question: a) Compute the earnings per share for the current and previous years. b) Stockholders equity totaled $42,000 at the beginning of the previous year. Compute

a) Compute the earnings per share for the current and previous years.

b) Stockholders equity totaled $42,000 at the beginning of the previous year. Compute the return on equity (ROE) ratios for the current and previous years.

c) Net property and equipment totaled $45,000 at the beginning of the previous year. Compute the fixed asset turnover ratios for the current and previous years.

d) Compute the debt-to-assets ratios for the current and previous years.

e) Compute the times interest earned ratios for the current and previous years.

f) After Golden released its current years financial statements, the companys stock was trading at $50. After the release of its previous years financial statements, the companys stock price was $38 per share. Compute the P/E ratios for both years.

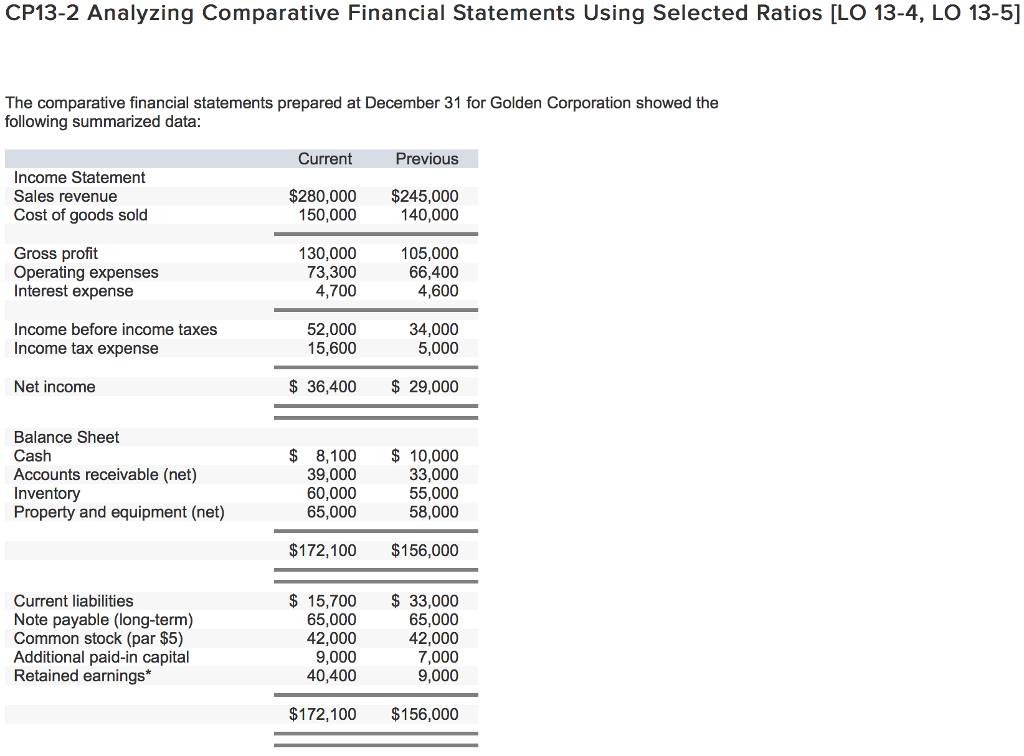

CP13-2 Analyzing Comparative Financial Statements Using Selected Ratios [LO 13-4, LO 13-5] The comparative financial statements prepared at December 31 for Golden Corporation showed the following summarized data Current Previous Income Statement Sales revenue Cost of goods sold $280,000 $245,000 140,000 150,000 Gross profit Operating expenses Interest expense 130,000 73,300 4,700 105,000 66,400 4,600 Income before income taxes Income tax expense 52,000 15,600 34,000 5,000 Net income $36,400 29,000 Balance Sheet Cash Accounts receivable (net) Inventory Property and equipment (net) $ 8,100 $10,000 33,000 55,000 58,000 39,000 60,000 65,000 $172,100 $156,000 Current liabilities Note payable (long-term) Common stock (par $5) Additional paid-in capital Retained earnings* $15,700 $33,000 65,000 42,000 7,000 9,000 65,000 42,000 9,000 40,400 $172,100 $156,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts