Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a/ Compute the ROE of the firm in 2014 (2 points) b/ Compute the ROE in 2014 if money was raised only through equity

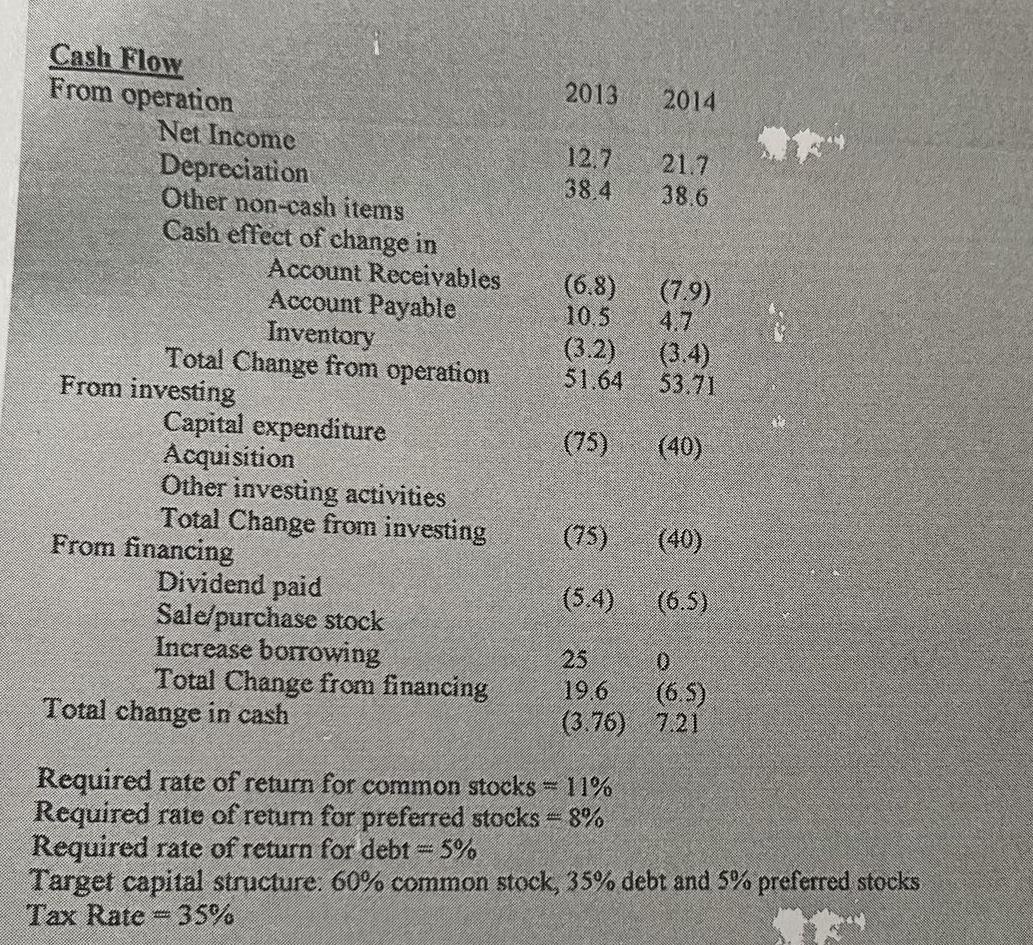

a/ Compute the ROE of the firm in 2014 (2 points) b/ Compute the ROE in 2014 if money was raised only through equity (3 points) c/ Compute the ROE in 2014 if the firm has 15% of debt instead. We suppose that the interest payment will be the same as the current interest payment plus or minus 0.8% (3 points) Cash Flow From operation Net Income Depreciation Other non-cash items Cash effect of change in Total Change from operation From investing Account Receivables Account Payable Inventory Capital expenditure Acquisition Other investing activities Total Change from investing From financing Dividend paid Sale/purchase stock Increase borrowing Total Change from financing Total change in cash 2013 12,7 38.4 (6.8) 10,5 (75) (5.4) 25 19.6 (3.76) 2014 (3.2) (3.4) 51.64 53.71 (75) (40) Required rate of return for common stocks = 11% Required rate of return for preferred stocks = 8% Required rate of return for debt = 5% 21.7 38.6 (7.9) 4.7 (40) (6.5) 0 (6.5) 7.21 **** Target capital structure: 60% common stock, 35% debt and 5% preferred stocks Tax Rate = 35%

Step by Step Solution

★★★★★

3.33 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Compute the ROE of the firm in 2014 ROE Net Income Average Total Shareholders Equity Net In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started