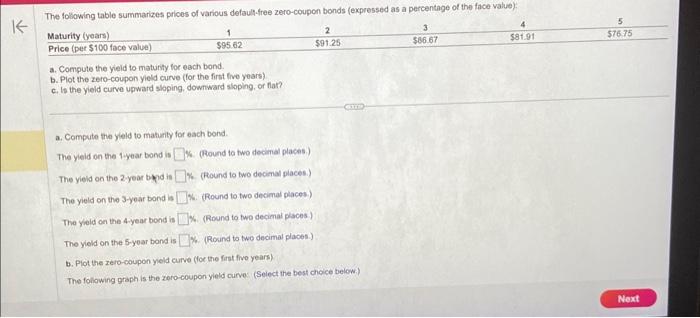

Question: a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years) c. Is the yieid curve

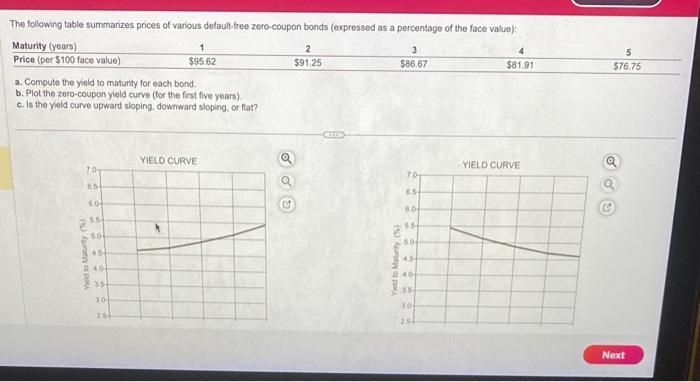

a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years) c. Is the yieid curve upward sloping. downward sloping, or far? a. Compute the yleld to maturity for each bond. The yieid on the 1 year bond is . If: (Round to two decinal places.) The yieid on the 2year berid in \%f. (Found to two decimal places.). The yield on the 3 year bond is N. (Round to two decimal places.) The yoleld on the 4 -year bond is \%. (Round to two decimal places) The yield on the 5 yoar bond is y. (Rosind to two decimal places.) b. Plot the zero-coupon yield curve (for the finst five years) The follawing graph is the zero-coupon yield curves (Select the best cheice below.) a. Compute the yiveld to maturty for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yeld curve upward sloping, downward sloping, or fat? c. Is the yield curve upward sloping, downward sloping, or flat? (Select from the drop-down menu.) The yield curve is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts