Question: (a) Consider a 15-year $100 par value coupon bond with semi-annual coupons selling at $121.22. The bond can be first called in 6 years at

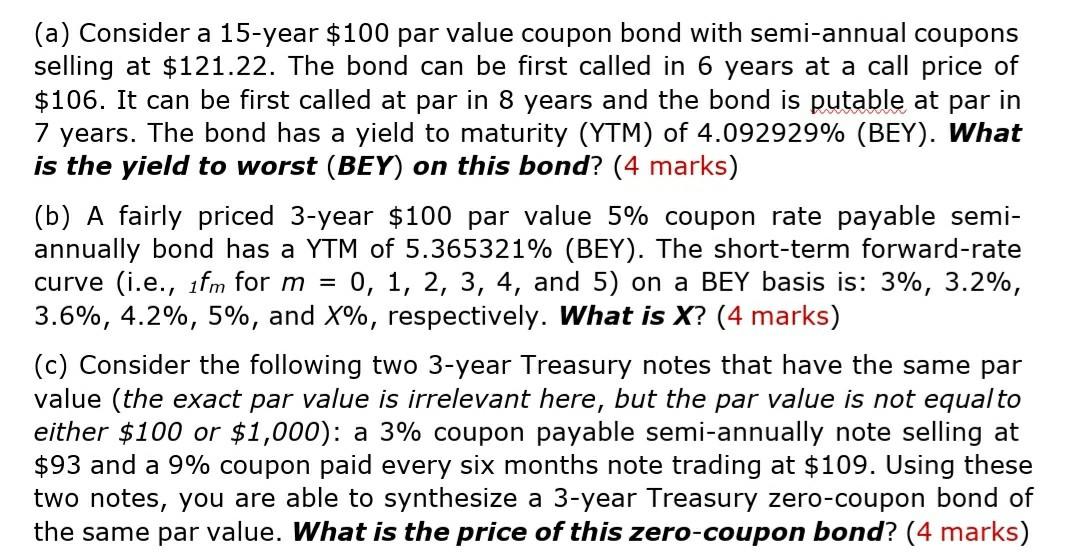

(a) Consider a 15-year $100 par value coupon bond with semi-annual coupons selling at $121.22. The bond can be first called in 6 years at a call price of $106. It can be first called at par in 8 years and the bond is putable at par in 7 years. The bond has a yield to maturity (YTM) of 4.092929% (BEY). What is the yield to worst (BEY) on this bond? (4 marks) (b) A fairly priced 3-year $100 par value 5% coupon rate payable semi- annually bond has a YTM of 5.365321% (BEY). The short-term forward-rate curve (i.e., ifm for m = 0, 1, 2, 3, 4, and 5) on a BEY basis is: 3%, 3.2%, 3.6%, 4.2%, 5%, and X%, respectively. What is X? (4 marks) (c) Consider the following two 3-year Treasury notes that have the same par value (the exact par value is irrelevant here, but the par value is not equal to either $100 or $1,000): a 3% coupon payable semi-annually note selling at $93 and a 9% coupon paid every six months note trading at $109. Using these two notes, you are able to synthesize a 3-year Treasury zero-coupon bond of the same par value. What is the price of this zero-coupon bond? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts