Question: a) Consider a putable bond that has 3 years to maturity, par value of 100 and a coupon rate of 4.5%. It is putable at

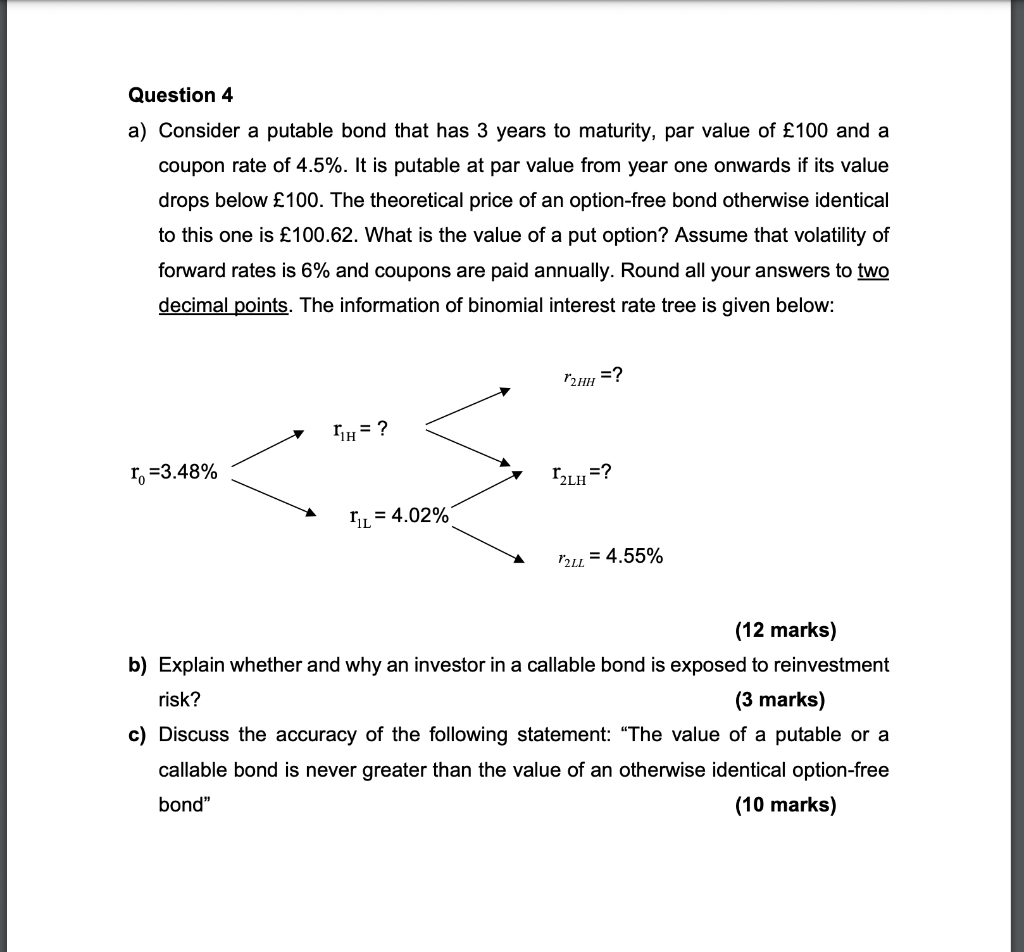

a) Consider a putable bond that has 3 years to maturity, par value of 100 and a coupon rate of 4.5%. It is putable at par value from year one onwards if its value drops below 100. The theoretical price of an option-free bond otherwise identical to this one is 100.62. What is the value of a put option? Assume that volity of forward rates is 6% and coupons are paid annually. Round all your answers to two decimal points. The information of binomial interest rate tree is given below: (12 marks) b) Explain whether and why an investor in a callable bond is exposed to reinvestment risk? (3 marks) c) Discuss the accuracy of the following statement: "The value of a putable or a callable bond is never greater than the value of an otherwise identical option-free bond" (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts