Question: Use the information about SyncTech, Inc . provided above to answer the following questions. Question 1 a. Determine the firm's basic EPS for

Use the information about SyncTech, Inc. provided above to answer the following questions.

Question 1

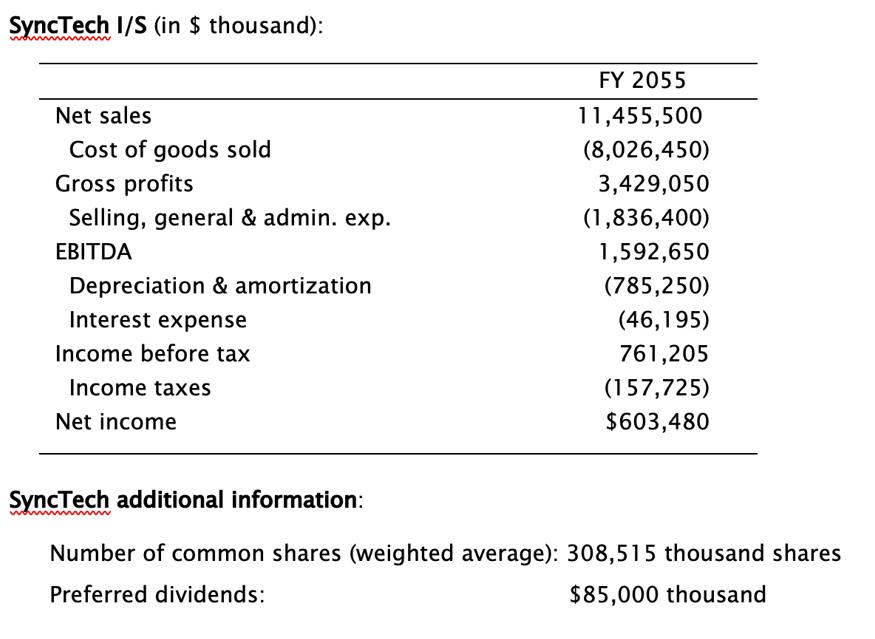

a. Determine the firm's basic EPS for FY 2055.

b. Determine the firm's receivable turnover ratio for FY 2055.

Question 2

a. Compute the firm's ROCE for FY 2055 (*ignore the adjustment for interest expenses) and decompose it into three components (a.k.a. DuPont analysis).

b. Suppose that the firm's assets were 100% financed through equity (i.e., no liability). What would the difference between ROA and ROCE be

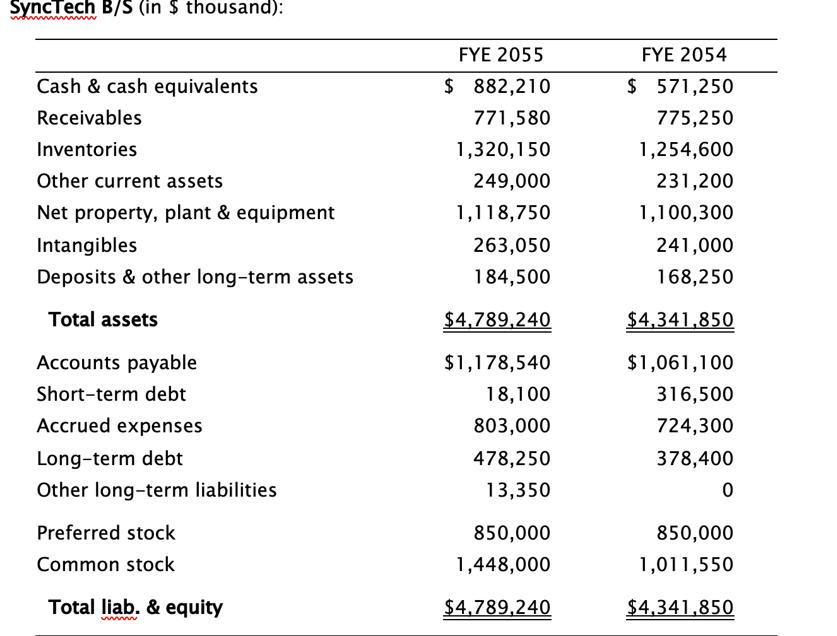

SyncTech B/S (in $ thousand): Cash & cash equivalents Receivables Inventories Other current assets Net property, plant & equipment Intangibles Deposits & other long-term assets Total assets Accounts payable Short-term debt Accrued expenses Long-term debt Other long-term liabilities Preferred stock Common stock Total liab. & equity wwwwww FYE 2055 $882,210 771,580 1,320,150 249,000 1,118,750 263,050 184,500 $4,789,240 $1,178,540 18,100 803,000 478,250 13,350 850,000 1,448,000 $4,789,240 FYE 2054 $ 571,250 775,250 1,254,600 231,200 1,100,300 241,000 168,250 $4,341,850 $1,061,100 316,500 724,300 378,400 0 850,000 1,01 1,550 $4,341,850 SyncTech B/S (in $ thousand): Cash & cash equivalents Receivables Inventories Other current assets Net property, plant & equipment Intangibles Deposits & other long-term assets Total assets Accounts payable Short-term debt Accrued expenses Long-term debt Other long-term liabilities Preferred stock Common stock Total liab. & equity wwwwww FYE 2055 $882,210 771,580 1,320,150 249,000 1,118,750 263,050 184,500 $4,789,240 $1,178,540 18,100 803,000 478,250 13,350 850,000 1,448,000 $4,789,240 FYE 2054 $ 571,250 775,250 1,254,600 231,200 1,100,300 241,000 168,250 $4,341,850 $1,061,100 316,500 724,300 378,400 0 850,000 1,01 1,550 $4,341,850

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Question 1 a To determine the firms basic EPS Earnings Per Share for FY 2055 we need the net income and the number of common shares Net income 603480 ... View full answer

Get step-by-step solutions from verified subject matter experts