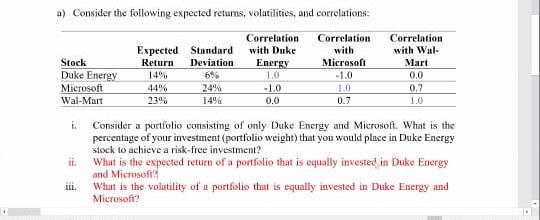

Question: a) Consider the following expected retums, volatilities, and eocrelations: i. Consider a portfolio consisting of only Duke Energy and Microsoft. What is the persentage of

a) Consider the following expected retums, volatilities, and eocrelations: i. Consider a portfolio consisting of only Duke Energy and Microsoft. What is the persentage of your investment (portfolio weight) that you would place in Duke Energy stock to achieve a risk-free investment? ii. What is the expected return of a portfolio that is equally invested in Duke Energy and Micrusoff? iii. What is the volutility of II portfolio that is equally invested in Duke Energy and Microsoft

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock