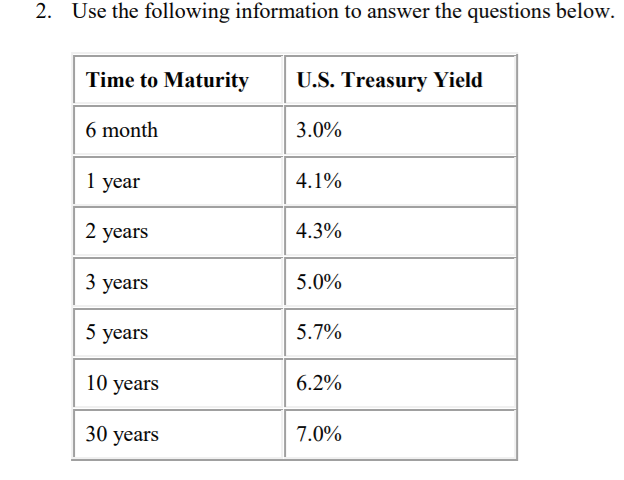

Question: a. Construct a yield curve graph (chart) using a spreadsheet program based on the above information. Make sure you label your axes. Hint: In Excel,

a. Construct a yield curve graph (chart) using a spreadsheet program based on the above information. Make sure you label your axes. Hint: In Excel, an XY scatter chart looks best.

b. Classify the shape of your yield curve, i.e. flat, downward (inverted), or upward (normal) sloping. Define what each shape means regarding the term structure of interest rates.

c. What does the shape of your yield curve mean about future interest rates according to the pure expectations theory and the market segmentation theory? Can liquidity preference theory explain the shape of your yield curve?

d. What is the expected one-year Treasury yield one year from today (the expected one-year rate for year 2) according to the expectations theory? What is the expected year 2 inflation rate if the real rate of interest (k*) is 2% according to this same theory?

e. What is the expected one-year Treasury yield two years from today (the expected one- year rate for year 3) according to the expectations theory? What is the expected year 3 inflation rate if the real rate of interest (k*) is 2% according to this same theory?

f. What is the expected two-year Treasury yield one year from today (the expected two year rate for year 2 and 3) according to the expectation theory?

g. What is the expected two-year Treasury yield three years from today (the expected two- year rate for year 4 and 5) according to the expectations theory?

h. Now, lets say you believe in the liquidity preference theory, and the maturity risk premium is given by the formula (t-1)0.1% where t is years to maturity. What is the expected average annual rate of inflation over the next 10 years if the real rate of interest (k*) is 1%?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts